- What we do

- Pan-European Guarantee Fund – EGF

- TechEU

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Innovation Romania Holding Fund

- NPI SM-CDTI Innvierte Tech Transfer and Deep Tech

- ILTE: Co-investments into private credit funds

- RRF Spain - Alternative Lending for Sustainable Development

- EquiFund II

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czechia

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- SEGIP VC Fund - Call for expression of interest

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

- EU4 Business Guarantee Facility and Grant Facility Call for Expression of Interest

- JEREMIE Romania Reflows

- Fomento Portugal Tech

ERP-EIF Co-Investment Growth Facility

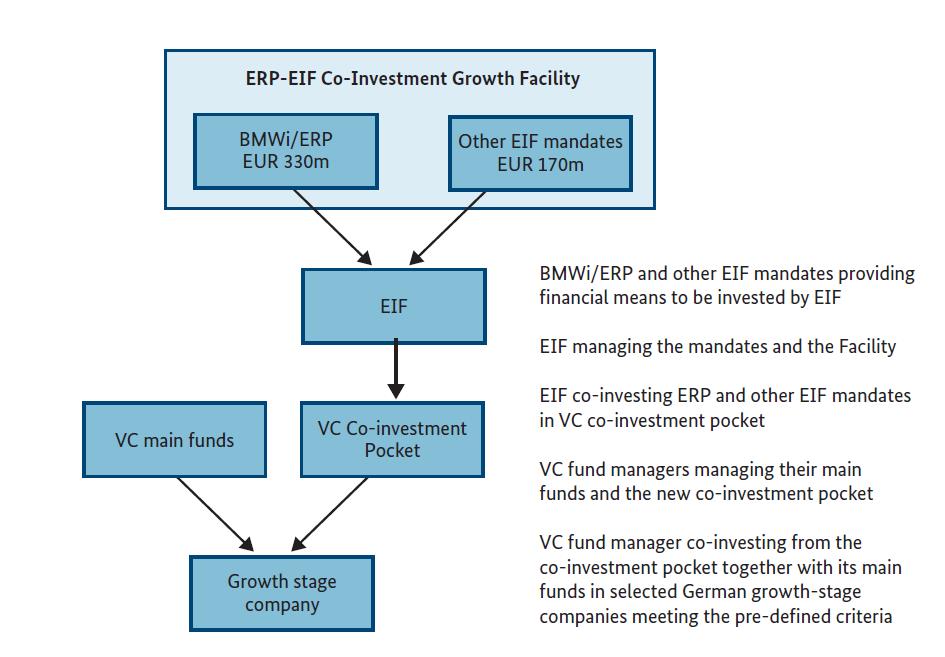

The German Growth Co-Investment Facility is a EUR 500m facility managed by EIF on behalf of the German Federal Ministry of Economic Affairs and Energy (BMWi) and the European Recovery Programme (ERP). The facility was launched in March 2016 to boost venture capital support for growth phase companies in Germany.

By co-investing with successful venture capital fund managers alongside their funds, it targets innovative German SMEs and Mid-Caps in their expansion and internationalisation phase, often seeking equity. The facility can invest in both new and existing portfolio companies of a fund manager’s main funds. The facility is funded with EUR 330m from the German Federal Minister for Economic Affairs and Energy (BMWi) on behalf of the European Recovery Programme (ERP) and with EUR 170m from the EIF.

How does the facility work?

The facility provides qualified fund managers with co-investment pockets of EUR 20-60 million across an investment period running until 31 December 2021. Should the investment proposal meet the criteria listed below, your proposal will be subject to an initial screening before the EIF undertakes to start a due diligence process and brings the proposal further through EIF’s approval steps.

Are you a fund manager interested in partnering with us under the ERP-EIF Co-Investment Growth Facility?

EIF, as manager of the facility, will provide co-investment capital to reputable VC fund managers who:

- Are active in Germany and invest into SMEs and Mid-Caps based in Germany;

- Have an established EIF relationship;

- Can demonstrate an excellent track record;

- Have investment opportunities in their existing portfolio with the potential to meet the investment criteria set for a growth stage portfolio company.

Read more about the details to include in your investment proposal

What are pre-defined co-investment criteria for the target growth companies?

The fund manager may use the facility for investment opportunities (no separate EIF approval or Due Diligence required with respect to individual investments) when the following co-investment criteria are met:

- Existing or new portfolio company of one of the fund manager’s main funds;

- Run-rate revenues of more than EUR 5m and expected continued rapid growth;

- for companies active in drug development financing of clinical phase II trials (without the need to show revenues);

- Investment round of more than EUR 10m;

- Valuation representing an up-round of more than 10% compared to the last post-money valuation, set by a third party investor leading or co-leading the round to provide arm’s length valuation (not applicable to co-investments in new portfolio companies);

- Expected return of 2x or better and a realistic exit window within the next 12-36 months;

- The company should be a German SME or Mid-Cap (EC definition).

For SMEs and entrepreneurs looking for equity investments:

If you are looking for funding and would like to see which financial intermediaries currently cooperate with us, please visit http://www.eif.org/what_we_do/where/index.htm and contact the intermediary in your country directly. For information about finance available under further EU initiatives, please visit http://europa.eu/youreurope/business/funding-grants/access-to-finance

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.