- What we do

- Pan-European Guarantee Fund – EGF

- TechEU

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Innovation Romania Holding Fund

- NPI SM-CDTI Innvierte Tech Transfer and Deep Tech

- ILTE: Co-investments into private credit funds

- RRF Spain - Alternative Lending for Sustainable Development

- EquiFund II

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czechia

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- SEGIP VC Fund - Call for expression of interest

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

- EU4 Business Guarantee Facility and Grant Facility Call for Expression of Interest

- JEREMIE Romania Reflows

- Fomento Portugal Tech

New EIB Group report highlights the impact of cohesion support

- Date: 27 July 2022

- EIB lending in the European Union’s poorer regions helped reduce the economic impact of the COVID-19 pandemic.

- In 2021 the EIB Group provided €36.6 billion of finance to EU cohesion regions, representing 46.8% of the Group’s total financing volumes in 2021.

- Climate and cohesion goals are interlinked and mutually reinforce each other.

Lending in support of EU cohesion policy by the European Investment Bank Group (EIB Group) helped contain the economic fallout from the pandemic and could now help counter some of the short-term fallout from the war in Ukraine, says a new report, EIB Group Activities in EU Cohesion Regions.

Promoting cohesion has been a core mission of the Bank since its foundation in 1958. Over the course of the European Union’s last long-term budget, between 2014 and 2020, the EIB Group supported investments worth around €630 billion in poorer, “cohesion” regions, equivalent to about 16% of the European Union’s gross domestic product. According to the report, the impact and long-term benefits of these investments go even further than containing immediate economic shocks. By 2040, the investments supported between 2014 and 2020 are expected to raise EU gross domestic product (GDP) by an estimated 4.7% above the baseline scenario, and lead to the creation of an additional 3.2 million jobs.

The report, which follows the new cohesion orientation that the Bank adopted last October, examines the activities of the EIB Group in cohesion regions in 2021 in terms of policy objectives, activity sectors, countries, contribution to the United Nations Sustainable Development Goals (SDGs) and sector-specific project results. It features case studies from across the European Union, outlines the economic and social challenges facing cohesion regions and reviews the macroeconomic impact of the Group’s support.

You can read the full report here.

“In response to all the challenges facing the European Union and its Member States, the EU bank is increasing both its lending and advisory support for cohesion,” said EIB Vice-President Lilyana Pavlova. “This report, the first of its kind, clearly shows that the EIB’s support for cohesion policy is making a positive difference for citizens and businesses. I hope that the report can also inspire policymakers and business leaders, showing how they can best use the EIB Group’s tools to help their communities thrive.”

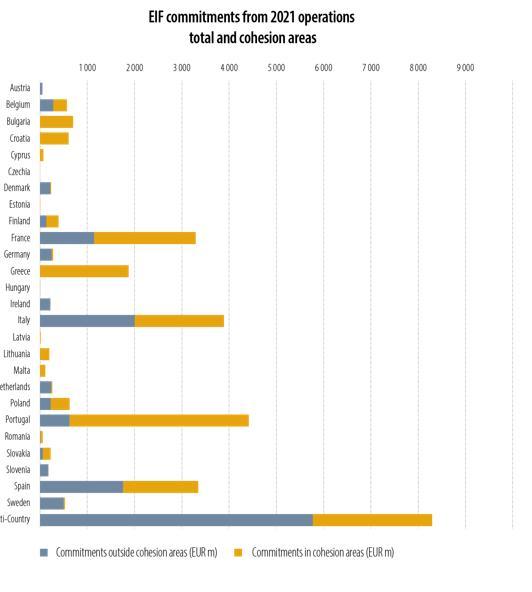

European Investment Fund Chief Executive, Alain Godard, said: “We are delighted to publish this first report concerning our cohesion activities. With €16.8 billion worth of transactions signed in 2021, we have provided strong support to the SMEs located in the less developed regions of Europe. Cohesion is a key strategic priority for the EIF and, going forward, we have reinforced our commitment by dedicating a large part of our future activities to these areas.”

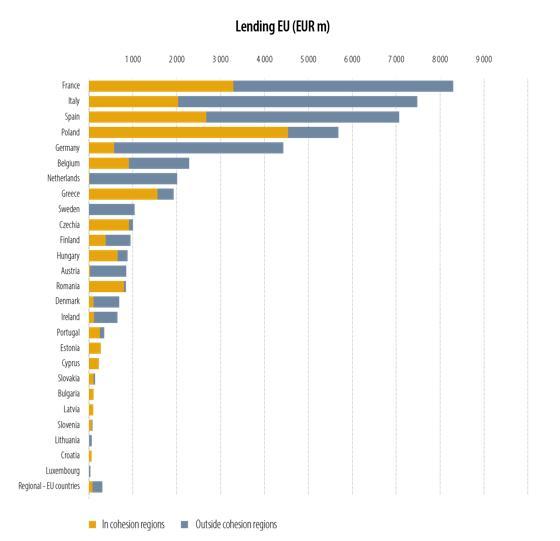

EIB Group operations in cohesion regions by country

In 2021, the EIB Group provided €36.6 billion to projects in EIB cohesion regions. For the EIB, this represented 41.5% of its 2021 EU lending, well above the share of cohesion regions in the European Union’s economy (35% based on GDP). EIB lending supported projects worth €47.3 billion in cohesion regions. In terms of lending to cohesion regions, Poland obtained the most (€4.5 billion), followed by cohesion regions in France (€3.3 billion) and Spain (€2.7 billion). Relative to the size of their economies, Greece, the Czech Republic and Romania also benefited from high cohesion lending volumes with €1.6 billion, €0.9 billion and €0.8 billion, respectively.

Transactions signed by the EIF in 2021 totalled €16.8 billion and provided support to SMEs and other eligible final recipients located in cohesion regions in 25 of the EU’s 27 Member States. The support was mainly through debt/guarantee and equity financial instruments. In absolute terms, the cohesion regions that are expected to benefit the most from EIF transactions signed in 2021 are in Portugal, Italy and Spain. Relative to GDP, however, EIF support for cohesion areas in 2021 is expected to be greater in Bulgaria and Croatia.

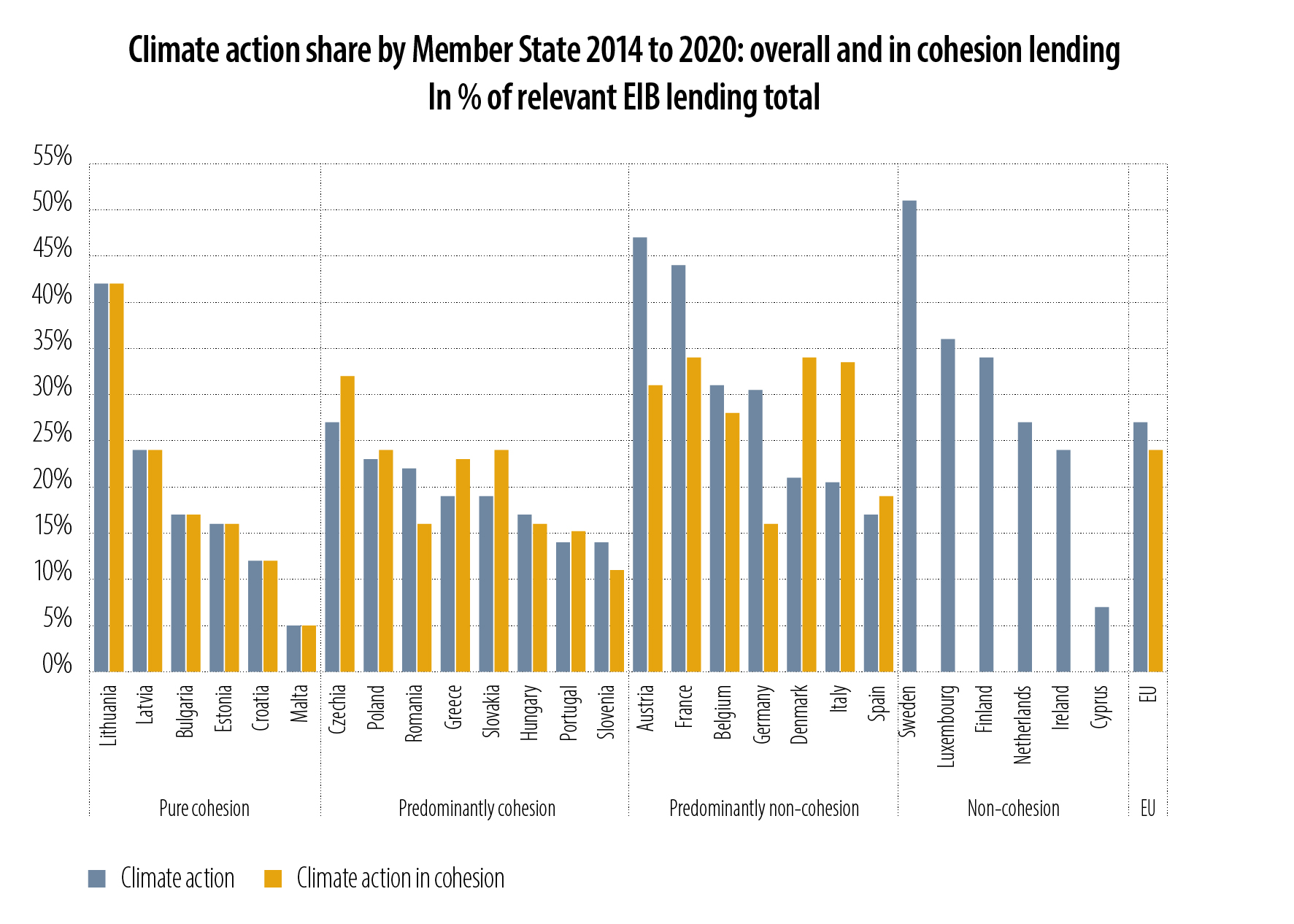

The climate-cohesion nexus

Investments in climate action and a sustainable environment are not at the expense of cohesion objectives. On the contrary, climate investments can play a vital role both in delivering on EU cohesion policy objectives and in paving the way for the green transition.

Increased support for climate action and environmental sustainability activities is particularly relevant for cohesion regions, as they have historically suffered from a lower level of public investment in climate mitigation, adaptation and environmental sustainability. Many of these regions are also more exposed to climate and environmental threats and will potentially be more significantly affected by the social and economic challenges of decarbonisation than non-cohesion regions.

In practice, 2021 lending data show that climate action and environmental sustainability and cohesion are interlinked priorities, with 23% of the Bank’s lending volume being in both climate action/environmental sustainability and cohesion.

Background information

The European Investment Bank (EIB) is the long-term lending institution of the European Union owned by its Member States. It makes long-term finance available for sound investment in order to contribute towards EU policy goals. Financing projects that help strengthen the economic, social and territorial cohesion of the European Union has been at the heart of EIB operations since its foundation in 1958.

Its lending in cohesion areas covers the full spectrum of economic activity and must fall under at least one of the EIB’s four priorities: sustainable cities and regions; sustainable energy and natural resources; innovation, digital and human capital and small and medium-sized enterprises (SMEs). EIB cohesion regions encompass less developed regions (GDP per capita of less than 75% of the EU average) and transition regions (GDP per capita of between 75% and 100% of the EU average), as defined by the EU cohesion policy map.

The European Investment Fund (EIF) is part of the EIB Group. It supports Europe’s SMEs by improving their access to finance through a wide range of selected financial intermediaries. The EIF designs, promotes and implements equity and debt financing instruments targeting SMEs. In this role, the EIF fosters EU objectives in support of entrepreneurship, growth, innovation, research and development, the green and digital transitions and employment.

Press contacts

Vanessa Paul, v.paul@eib.org, tel.: +352 43 79 84331 / mobile: +352 621 368 521

Website: www.eib.org/press — Press Office: +352 4379 21000 — press@eib.org

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.