- What we do

- Pan-European Guarantee Fund – EGF

- TechEU

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Innovation Romania Holding Fund

- NPI SM-CDTI Innvierte Tech Transfer and Deep Tech

- ILTE: Co-investments into private credit funds

- RRF Spain - Alternative Lending for Sustainable Development

- EquiFund II

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czechia

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- SEGIP VC Fund - Call for expression of interest

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

- EU4 Business Guarantee Facility and Grant Facility Call for Expression of Interest

- JEREMIE Romania Reflows

- Fomento Portugal Tech

Investment Plan for Europe: EUR 200 million for Austrian SMEs as EIF and Bank Austria sign first EFSI deal

- Date: 07 July 2016

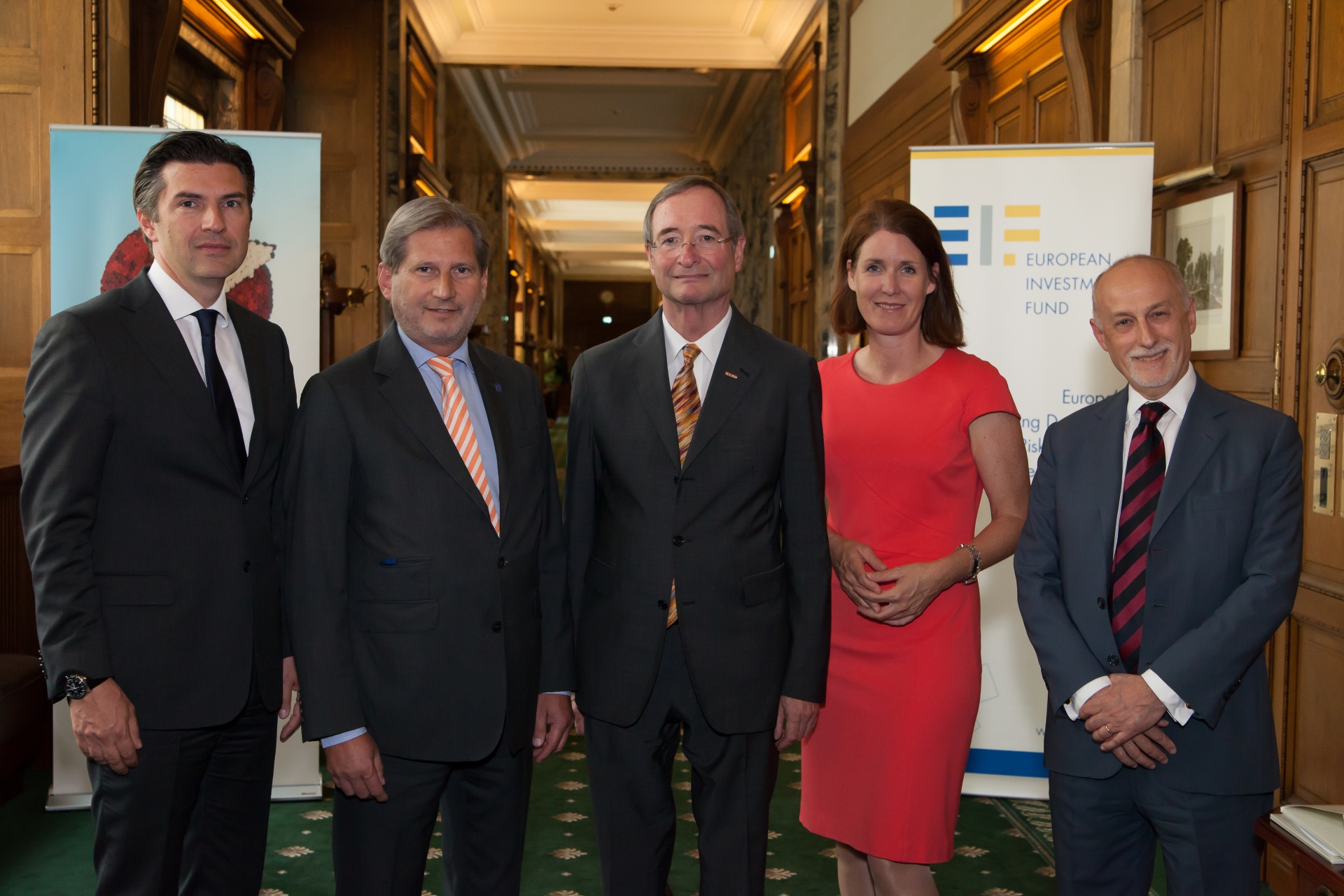

The European Investment Fund (EIF) and UniCredit Bank Austria (Bank Austria) have signed the first InnovFin SME agreement in Austria, benefiting from the support of the European Fund for Strategic Investments (EFSI), at the heart of the Investment Plan for Europe.

The InnovFin agreement allows Bank Austria to provide loans to innovative companies in Austria over the next 2 years, with the support of a guarantee provided by the EIF and backed under Horizon 2020, the EU Framework Programme for Research and Innovation. The EU support for innovative Austrian companies is expected to generate a portfolio of EUR 200 million loans.

Speaking at the signing event in Austria, EU Commissioner for European Neighbourhood Policy & Enlargement Negotiations, Johannes Hahn said: “I am very proud to be here in Vienna to participate in the signing event between the EIF and Bank Austria for this first SME agreement under the Investment Plan in Austria. The agreement signed today will provide Austrian SMEs with access to EUR 200 million in new loans to expand their businesses which is an excellent start.”

Commenting on the signature, EIF Chief Executive Officer, Pier Luigi Gilibert said: “EUR 200 million is a significant amount of EFSI backed finance for companies in Austria and we strongly believe that this will help to support the innovation agenda for Austrian SMEs and small mid-caps. Bank Austria was the first bank to benefit from the predecessor programme – RSI which targeted innovative companies and I am pleased that we can renew our cooperation by signing this InnovFin SME Guarantee agreement.”

Christoph Leitl, President of the Austrian Economic Chamber, said: “This is a very valuable contribution from the perspective of the Austrian business sector. We know from regular company surveys that access to finance is a key issue. Collateral which can be offered to banks is an essential factor in this context. The objective of the guarantee agreement is also of great significance for Austria because we need to intensify our innovation efforts if we want to be among the leading countries in this area.” What is needed most in the current situation is renewed growth in investment: “We need to significantly enhance our competitiveness by meeting the challenges that result from economic trends and from a value chain driven by industry 4.0 in manufacturing. Quite generally, it is important to make better use of EU funding”, said the President of the Austrian Economic Chamber.

Bank Austria Chief Executive Officer, Robert Zadrazil said: “We are very pleased to be the first commercial bank in Austria to offer our customers the InnovFin SME agreement. With this agreement we can continue the success of the predecessor programme RSI, which EIF and our Bank could increase due to the great success and high demand in Austria. The InnovFin initiative enables us to make available loans with a total volume of EUR 200 million to innovative and research-oriented small and medium-sized enterprises and mid-corporates on very favourable terms. SMEs will benefit in two ways: they will get additional collateral from the EIF at a very low price and they will benefit from even more attractive terms as we fully pass on to our customers the guarantee-related cost advantages. Bank Austria is thereby offering additional financing opportunities for innovative companies, underlining its role as the leading provider of loans in Austria.”

Support under EFSI translates into a quicker positive impact for InnovFin agreements, such as this one signed today with Bank Austria, leading to further investments, growth and faster economic recovery in Europe.

About EIF

The European Investment Fund (EIF) is part of the European Investment Bank group. Its central mission is to support Europe's micro, small and medium-sized businesses (SMEs) by helping them to access finance. EIF designs and develops venture and growth capital, guarantees and microfinance instruments which specifically target this market segment. In this role, EIF fosters EU objectives in support of innovation, research and development, entrepreneurship, growth, and employment. More information on the EIF's work under the EFSI is available here.

About Bank Austria

UniCredit Bank Austria is the leading bank in Austria and Central and Eastern Europe. The bank has been a member of UniCredit, one of the largest European banking groups, since 2005. Bank Austria is constantly striving to maintain the highest level of customer satisfaction. Bank Austria is a modern and dynamic universal bank offering its customers access to international financial markets.

Bank Austria supports Austria’s economy by providing special offers for innovative SMEs – from excellent advisory services in the start-up phase to modern, flexible financing solutions including funding all the way to business planning and succession planning. Bank Austria has successfully passed EIFs extensive application and due-diligence process regarding its SME strategy, financial standing, risk models, origination power, marketing initiatives and proved in particular its bundled know-how in export- and investment promotion funding and advisory and therefore is an ideal partner for EIF to start this important new EU facility in Austria.

About the Investment Plan for Europe

The Investment Plan focuses on removing obstacles to investment, providing visibility and technical assistance to investment projects and making smarter use of new and existing financial resources. The Investment Plan is already showing results. The European Investment Bank (EIB) estimates that by June 2016, the European Fund for Strategic Investments (EFSI) triggered more than EUR 106.8 billion of investment in Europe.

Find out the latest EFSI figures including a break-down by sector and by country here. For more information see the FAQs.

About InnovFin

The InnovFin SME Guarantee Facility provides guarantees and counter-guarantees on debt financing of between EUR 25,000 and EUR 7.5 million in order to improve access to loan finance for innovative small and medium-sized enterprises and small mid-caps (up to 499 employees). The facility is managed by the EIF, and is rolled out through financial intermediaries – banks and other financial institutions – in EU Member States and Associated Countries. Under this facility, financial intermediaries are guaranteed by the EIF against a proportion of their losses incurred on the debt financing covered under the facility.

Press contacts:

EIF: David Yormesor

tel: + 352 24 85 81 346, e-mail: d.yormesor@eif.org

Bank Austria: Martin Halama

tel: + 43 (0)5 05 05 52371, e-mail: martin.halama@unicreditgroup.at

European Commission: Siobhán Millbright

tel: + 32 (0)2 29 57 36, e-mail: siobhan.millbright@ec.europa.eu

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.