- What we do

- Pan-European Guarantee Fund – EGF

- TechEU

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Innovation Romania Holding Fund

- NPI SM-CDTI Innvierte Tech Transfer and Deep Tech

- ILTE: Co-investments into private credit funds

- RRF Spain - Alternative Lending for Sustainable Development

- EquiFund II

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czechia

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- SEGIP VC Fund - Call for expression of interest

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

- EU4 Business Guarantee Facility and Grant Facility Call for Expression of Interest

- JEREMIE Romania Reflows

- Fomento Portugal Tech

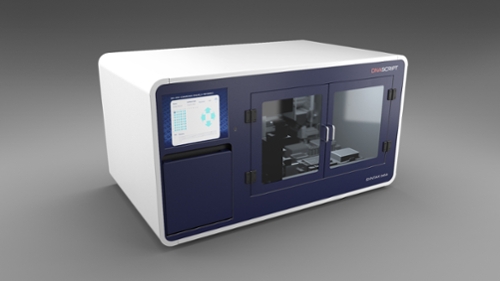

DNA Script: synthetic DNA on demand

DNA Script was created to revolutionize access to synthetic DNA. The technology that the company has developed allows for a rapid, convenient way to access DNA on demand through SYNTAX, the world’s first benchtop DNA printer powered by enzymatic technology.

“Getting access to synthetic DNA is a real challenge for any life-science project. Our aim is to provide a tool that will allow life-science teams to manufacture the synthetic DNA they need for their project on-site in a matter of a few hours rather than several days,” explains Thomas Ybert, co-founder and CEO of DNA Script. “To synthesise DNA today, you need the infrastructure to work with dangerous chemicals. We conceptualised an alternative way of synthesising DNA using enzymes instead of chemicals. It’s faster, easier, safer and can be done on-site. Ultimately, the time saved will make a huge difference in terms of control measures, cases, casualties and economic impact.”

In the context of a pandemic, DNA synthesis will be key in the development of any vaccine… “Ultimately, we want to deploy our devices as broadly as possible, down to local hospitals,” says Thomas. “Imagine a new outbreak in a remote region, a new virus… With our instrument, they could quickly provide the DNA needed to sequence the first genome of the virus, and access critical information within hours. The same SYNTAX instrument will be able to iterate, very quickly, diagnostic tests, and then you can quickly test people, all within 24-48 hours. Without decentralised DNA synthesis devices, it could take days or even weeks to liaise with a centralised DNA production site. You can then confine potential infected people fast and stop a pandemic, without having to quarantine a whole continent. For the Covid-19 virus, it could still be useful to help monitor its evolution if it mutates. You need to update your knowledge, sequence the new virus mutants and update your tests, so we could play a role in that regard.”

In 2016, DNA Script received an important equity investment from Kurma Partners, a venture capital firm backed by the EIF, that helped the company on its path to professionalisation. “The seed financing helped us turn into a real company, make our first hires and move to the proof of concept stage. Initially we were just three early entrepreneurs, of which only one full-time.”

And the next step for DNA Script? “Well, we are just building our first beta prototype, and then we want to enter evaluation programmes, test the device around partners, get technical feedback and fine-tune it. When the machine is widely available, people will be asking themselves ‘how did we live without it’?”

Company: DNA Script (France)

Type of business: biotechnology

EIF financing: RCR mandate and own resources

Financial intermediary: Kurma Partners

For further information about EIF intermediaries in France, please refer to: http://www.eif.org/what_we_do/where/fr/index.htm

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.