- What we do

- Pan-European Guarantee Fund – EGF

- TechEU

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Innovation Romania Holding Fund

- NPI SM-CDTI Innvierte Tech Transfer and Deep Tech

- ILTE: Co-investments into private credit funds

- RRF Spain - Alternative Lending for Sustainable Development

- EquiFund II

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czechia

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- SEGIP VC Fund - Call for expression of interest

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

- EU4 Business Guarantee Facility and Grant Facility Call for Expression of Interest

- JEREMIE Romania Reflows

- Fomento Portugal Tech

Anshar Studios: the sum of your choices

Video-game development is a very fast-moving industry. “Budgets are getting bigger, games more complicated; the quality bar keeps rising with advances in technology. Gamers expect more. Software and development engines are also becoming more sophisticated and powerful, and on our side, we need to develop our own tools. It’s happening also in other areas like cinema,” he adds. “For a small independent studio like ours, inventiveness, passion and creativity are crucial. It is the only way to stand out in a noisy flooded market where the number of releases is exploding,” says Grzegorz Dymek, COO of Anshar Studios.

Lukasz Hacura, CEO, founded Anshar in 2012 with a group of developers in Katowice. The company develops complete video games from concept to launch, using state of the art technology that ensures photo-real visuals and an immersive experience. “Our motto is “gamedev or die”, says Grzegorz, “We are all passionate about game playing. In our view, this is the important part of building your advantage because being in it just for the money or just because it is popular is not the right approach.”

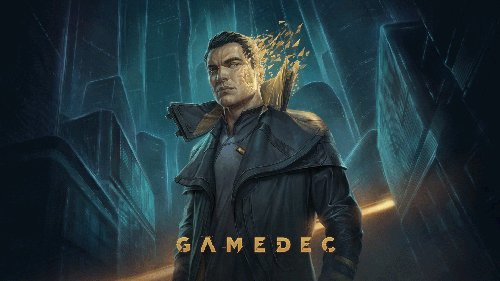

Anshar’s latest project is a game called Gamedec, a cyber-punk isometric role-playing-game. We’ve been working on that for the last four years. It’s around 300,000 words long in dialogue – that’s equivalent to all of the Harry Potter books,” he says. “Throughout the game, the choices you make will define your experience. It’s a bit like our job: exciting but also challenging.”

For Anshar, like for many others in their industry, cashflow is a major challenge. “Liquidity is the basic issue because you are constantly investing heavily in yourself. You need cash protection to secure yourself in case of delayed payments or unexpected expenses.” The company benefited from an EU-guaranteed loan through BGK, backed by the EIF under the Investment Plan for Europe, that gave them the cashflow they needed to push ahead with developing Gamedec, buy some licenses and build up their resources.

“Today, gaming is part of culture. People expect more than just entertainment; they are looking for new social experiences, to interact, compete or collaborate. I hope that we’ll achieve that with Gamedec, and keep creating rich, connected, and personalized experiences for gamers.”

Anshar, incidentally, is a word that means gates of heaven in the Sumerian language – Sumer being one of the earliest known civilisations in Mesopotamia. “Because we feel the sky’s the limit…” says Grzegorz.

Location: Katowice, Poland

Financial intermediary: BGK

SME: Anshar Studios

Sector: video games

Number of employees: 120

Financing purpose: cashflow; product development

EIF financing: Cultural & Creative Sectors Guarantee Facility (CCS), EFSI

For further information about EIF intermediaries in Poland, please refer to: http://www.eif.org/what_we_do/where/pl

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.