- What we do

- Pan-European Guarantee Fund – EGF

- TechEU

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Innovation Romania Holding Fund

- NPI SM-CDTI Innvierte Tech Transfer and Deep Tech

- ILTE: Co-investments into private credit funds

- RRF Spain - Alternative Lending for Sustainable Development

- EquiFund II

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czechia

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- SEGIP VC Fund - Call for expression of interest

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

- EU4 Business Guarantee Facility and Grant Facility Call for Expression of Interest

- JEREMIE Romania Reflows

- Fomento Portugal Tech

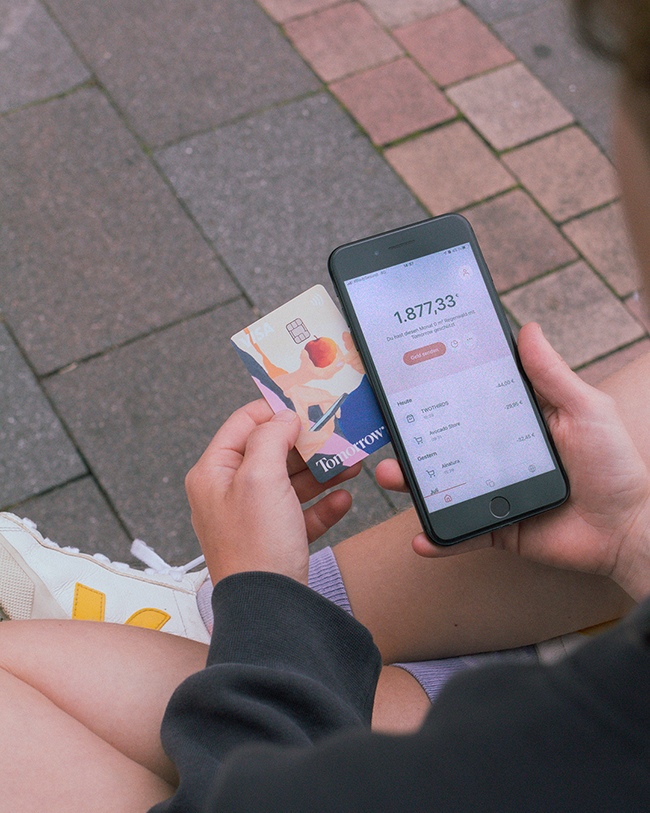

Tomorrow: starting today

“At Tomorrow, not a single cent goes into armaments, coal-fired power or genetic engineering,” says Michael. “We only finance sustainable projects. Every time you use your Tomorrow card, you're also making an active contribution to climate protection. This is how we create a better tomorrow, day after day,” explains Michael Schweikart, co-founder of Tomorrow.

Tomorrow was founded in 2017 in Hamburg. “At the beginning, we were thinking about the impact that money has and we felt that it’s moving the world in the wrong direction. For example, you would have thought things have changed, but since 2016, banks have invested USD 2.7tn into fossil fuels. We wanted to make it easier to create positive impact with your finances,” says Michael.

Michael and his co-founders set up a sustainable banking platform, partnering with Solaris Bank, offering a current account with an impact. The Tomorrow community’s deposits are invested in green bonds, which in turn invest in things like, renewable energy, renaturation, bike lanes, and microcredits to fund vulnerable entrepreneurs in the global south. “If you invest sustainably, say in water or energy, it’s not the case that you are making less profit.”

Tomorrow engages in a full impact investing process, starting with research, vetting criteria, making sure exclusion criteria are respected, checking reporting, transparency, and if UNSDGs are promoted. The company also allows users to monitor investments from their smartphone, including push notifications for every transaction, and insight at any time into the impact made by the Tomorrow community.

Bringing sustainability, transparency and technology together, in 2019, Tomorrow received an equity investment from ETF Partners, a venture capital firm backed by the EIF under the EU’s Investment Plan for Europe. This has helped the company boost product development and the sales and marketing teams as they look to internationalise. “For the moment, we’re active mainly in Germany, but we’re are looking to expand to other Western European countries soon,” says Michael.

“We need change on all levels if we want to succeed. Politics need to change direction, to get big capital flowing in the right direction. Behavioural change on the consumer side is also very powerful and often underestimated. Voting with your spending can definitely help bring about change. Similarly, our behavioural traits: do we really need a 5th pair of jeans? Overall, I’m optimistic. We believe a lot in innovation and things are moving rapidly. Politicians are also becoming more aware that they need to act. There’s still conservative forces pushing, but sustainable powers are growing stronger everywhere,” explains Michael.

Company: Tomorrow (Germany)

Type of business: environment; fintech; ICT

Financial intermediary: ETF Partners

EIF financing: RCR mandate and own resources, EFSI sub-window 1

For further information about EIF intermediaries in Germany, please refer to: http://www.eif.org/what_we_do/where/de/index.htm

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.