- What we do

- Pan-European Guarantee Fund – EGF

- TechEU

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Innovation Romania Holding Fund

- NPI SM-CDTI Innvierte Tech Transfer and Deep Tech

- ILTE: Co-investments into private credit funds

- RRF Spain - Alternative Lending for Sustainable Development

- EquiFund II

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czechia

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- SEGIP VC Fund - Call for expression of interest

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

- EU4 Business Guarantee Facility and Grant Facility Call for Expression of Interest

- JEREMIE Romania Reflows

- Fomento Portugal Tech

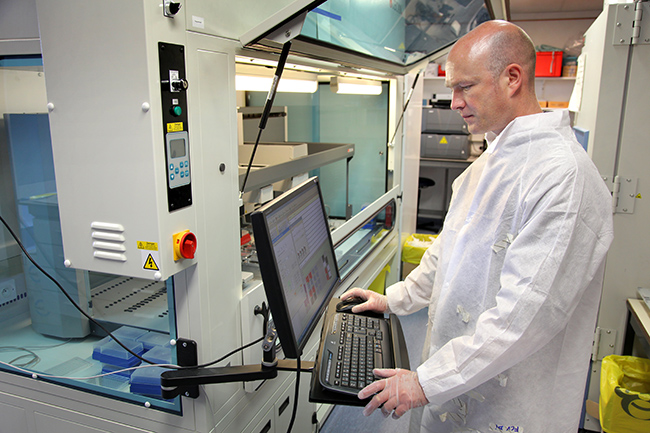

CD3: translating research to drugs

“We have to invest more in the discovery of drugs targeting dangerous and emerging viruses, and already start working now to counter the next pandemic.” explains Patrick Chaltin, Managing Director of CD3. “We actually have a list of multiple dangerous viruses for which we need to be more prepared, and that list included coronavirus. Together with Prof. J. Neyts from the Rega Institute, we’ve been highlighting that such a pandemic could happen for a long time and that antiviral drugs are needed alongside vaccines. This will not be the last pandemic, and building an antiviral line of defence would require much fewer resources compared to the impact of this pandemic. But I know it’s difficult for investors because there are typically no acute needs and no market.”

CD3, the Centre for Drug Design and Discovery, is an investment fund and drug discovery centre that aims to turn innovative biomedical research into drugs that can be further developed by pharmaceutical industry to treat all kinds of diseases. In June 2016, CD3’s capabilities were boosted by an important investment from the EIF under the EU’s Investment Plan for Europe. Using its drug discovery expertise, infrastructure and financial resources, CD3 works to bridge the gap between academic research and the pharmaceutical industry: “We will discover the products, validate the science and offer a product in hand that can be picked up by a pharmaceutical company to be developed to the benefit of patients,” Patrick adds.

“It’s a risky business, but there are now products in the clinic that wouldn’t have been there without our work. Typically, if one starts an investment on a new drug (very early stage), statistics will tell you that you have around 2% chance of making it on the market. If you can’t accept failure, you can’t be active in drug discovery. At CD3, we usually initiate around 6 new projects a year,” explains Patrick, “To date, out of 30 larger investments, 13 have been already been licensed out to partners and found a new home, thereby showing we close the gap successfully.“

Partnering with KU Leuven’s Rega Institute and academic and research institutions all over Europe and beyond, CD3 is a global partner in virology and a hotspot in the fight against Sars-Cov-2, working on 3 different approaches: first, screening their library of existing drugs against coronavirus to see whether repurposing could be achieved. Second, random screening of hundreds of thousands of compounds on the virus and using active compounds from such screening as starting points for the development of a potential antiviral drug; and third, exploring in depth the proteins of the virus, employing bioinformatics tools to identify potent inhibitors of the virus. “People talk a lot about finding a vaccine. But a drug is equally important. I think that in 2-3 years we could have a highly potent coronavirus drug in clinical development that could make the difference between life and death. ”

Type of business: healthcare

EIF financing: RCR mandate and own resources / EFSI

Financial intermediary: CD3

For further information about EIF intermediaries in Belgium, please refer to: http://www.eif.org/what_we_do/where/be/index.htm

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.