- What we do

- Pan-European Guarantee Fund – EGF

- TechEU

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Innovation Romania Holding Fund

- NPI SM-CDTI Innvierte Tech Transfer and Deep Tech

- ILTE: Co-investments into private credit funds

- RRF Spain - Alternative Lending for Sustainable Development

- EquiFund II

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czechia

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- SEGIP VC Fund - Call for expression of interest

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

- EU4 Business Guarantee Facility and Grant Facility Call for Expression of Interest

- JEREMIE Romania Reflows

- Fomento Portugal Tech

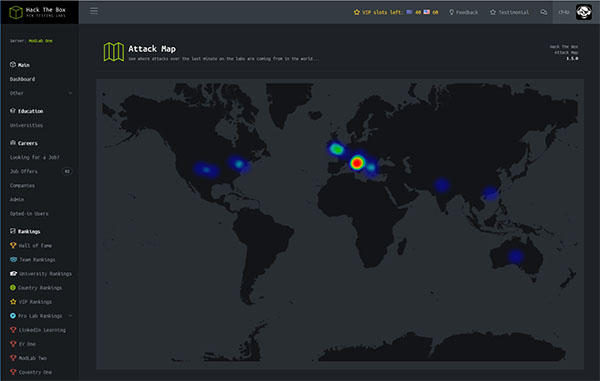

Hack the box: security playgrounds

“No, complex passwords don’t offer any real form of protection any more. If your protection is just a password, you can pretty much assume someone could be browsing through your data. Today, you need to have two-factor authentication, using things like tokens that produce one-time codes, or something like that,” explains Haris Pylarinos, CEO and founder of Hack The Box, an online platform that allows users to o test and advance their skills in penetration testing and cyber security.

“As a cybersecurity professional, I can tell you that the best way to train yourself to protect against hackers is…to hack. But, with the way legislation has developed, hacking can land you in jail, right? So what we did is set up a massive playground for cybersecurity professionals to learn and improve their penetration testing skills in a legal way. We set up fake companies for cybersecurity experts to try to hack,” he adds. “We work with individuals as much as with companies. For example, we work with two of the Big-Four accounting firms who use our labs to train their staff.”

What started as a community project in 2017 has grown into a very profitable enterprise, offering invaluable training to cybersecurity experts. The environment is controlled, and Hack The Box employs gaming elements like badges, team-play and hall of fame awards. “We even have universities competing against each other on our platforms,” Haris says. “Beyond our 128,000 users, every day we have 300-400 new members joining. Of course, to join, they need to hack the registration code.”

In March 2019, Hack The Box received an important investment from Marathon Venture Capital, a venture capital firm backed by the EIF, which, as Haris describes, was about more than just the financing: “We considered them an asset for the business. They understand start-ups, they have connections and they have been a great help. With their experience they’ve helped us avoid errors and traps. This kind of business guidance is invaluable.” With the financial injection, Hack The Box is working on product development, improving its free offerings, reconstructing its commercial offerings and investing in R&D for a new product that will offer real-time interaction between hackers.

“In the past, hacking used to be a big issue. It could ruin your computer. But today, the implications are so much bigger… With the Internet-of-Things (IoT) and computers so intricately connected to the real world, hackers could do a lot more damage, like sink a ship or set a building on fire. Cybersecurity professionals need to face up to these increased risks.” And every week, everything changes. One week, one thing is considered super-safe, but the next it’s history. A bit like those complex passwords…”At the end of the day, it’s the mindset that makes the difference,” Haris says. “If you are security-aware and care about protection, that’s what will keep you safe.”

Company: Hack the Box

Type of business: ICT

EIF financing: Equifund

Financial intermediary: Marathon Venture CapitalFor further information about EIF intermediaries in Greece, please refer to:

http://www.eif.org/what_we_do/where/el

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.