- What we do

- Pan-European Guarantee Fund – EGF

- TechEU

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Innovation Romania Holding Fund

- NPI SM-CDTI Innvierte Tech Transfer and Deep Tech

- ILTE: Co-investments into private credit funds

- RRF Spain - Alternative Lending for Sustainable Development

- EquiFund II

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czechia

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- SEGIP VC Fund - Call for expression of interest

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

- EU4 Business Guarantee Facility and Grant Facility Call for Expression of Interest

- JEREMIE Romania Reflows

- Fomento Portugal Tech

How EFSI benefits SMEs in Europe - Day One Capital case study: Recart (Hungary), ICT, e-commerce

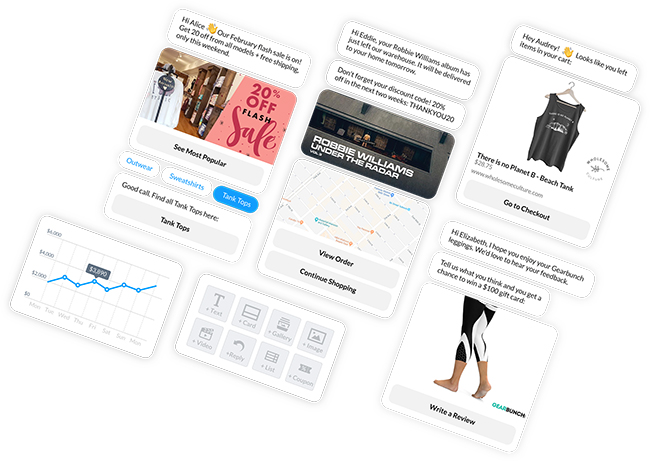

“This is the next generation of marketing: Instead of sending emails to a promotion folder, we help businesses get better results by automating chat conversations with their customers on Facebook Messenger. Whereas emails would have a 10-15% open rate, taking a conversational approach will get you 90-95% open rates - and 1/3 will actually engage too. No flooding inboxes, no spam. It’s more personal than any other channel,” explains Soma Toth, CEO of Recart.

Soma was already an e-commerce entrepreneur, running 6-7 different stores, and as online marketing on Facebook started to boom in 2012-2013, he began to move into the marketing space. In 2015 he founded Recart to help e-commerce merchants increase sales through messenger marketing. To date, more than 130,000 e-commerce merchants have already installed Recart, mainly in the lifestyle, gadgets and apparel industries.

There’s no secret behind Recart’s success, no sophisticated AI software. This is pure marketing know-how on the right channel. “The platform itself does a lot. Most people with smartphones check Facebook Messenger 7 times a day. Email is different – you can receive anything between 100 and 150 emails a day, many filtered to different folders. You don’t receive that many messages a day…” Recart offers a mostly automated chat experience that will take consumers through quizzes and tap into their behaviours. “We have key knowledge, templates, best practices to know how a positive marketing campaign can drive results, revenue and user experience. If we can get to a point where a customer drives 10-15% of their entire revenue from Facebook Messenger, that’s a successful set-up,” Soma adds.

In 2019, the company benefited from an equity investment from Day One Capital, a venture capital firm backed by the EIF under the EU’s Investment Plan for Europe, which helped with product development and building its sales and marketing arm, particularly in the USA. Looking ahead, the intention is to expand beyond Facebook Messenger to utilise other platforms as well: “We want to ensure that we can connect merchant to customer regardless of the communication channel. It’s still early in messaging marketing though. Most consumers haven’t experienced this yet. With penetration low, the opportunity in this area is huge…“

Company: Recart (Hungary)

Type of business: ICT, e-commerce

EIF financing: InnovFin Equity, EFSI

Financial intermediary: Day One Capital

For further information about EIF intermediaries in Hungary, please refer to: http://www.eif.org/what_we_do/where/hu

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.