- What we do

- Pan-European Guarantee Fund – EGF

- TechEU

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Innovation Romania Holding Fund

- NPI SM-CDTI Innvierte Tech Transfer and Deep Tech

- ILTE: Co-investments into private credit funds

- RRF Spain - Alternative Lending for Sustainable Development

- EquiFund II

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czechia

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- SEGIP VC Fund - Call for expression of interest

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

- EU4 Business Guarantee Facility and Grant Facility Call for Expression of Interest

- JEREMIE Romania Reflows

- Fomento Portugal Tech

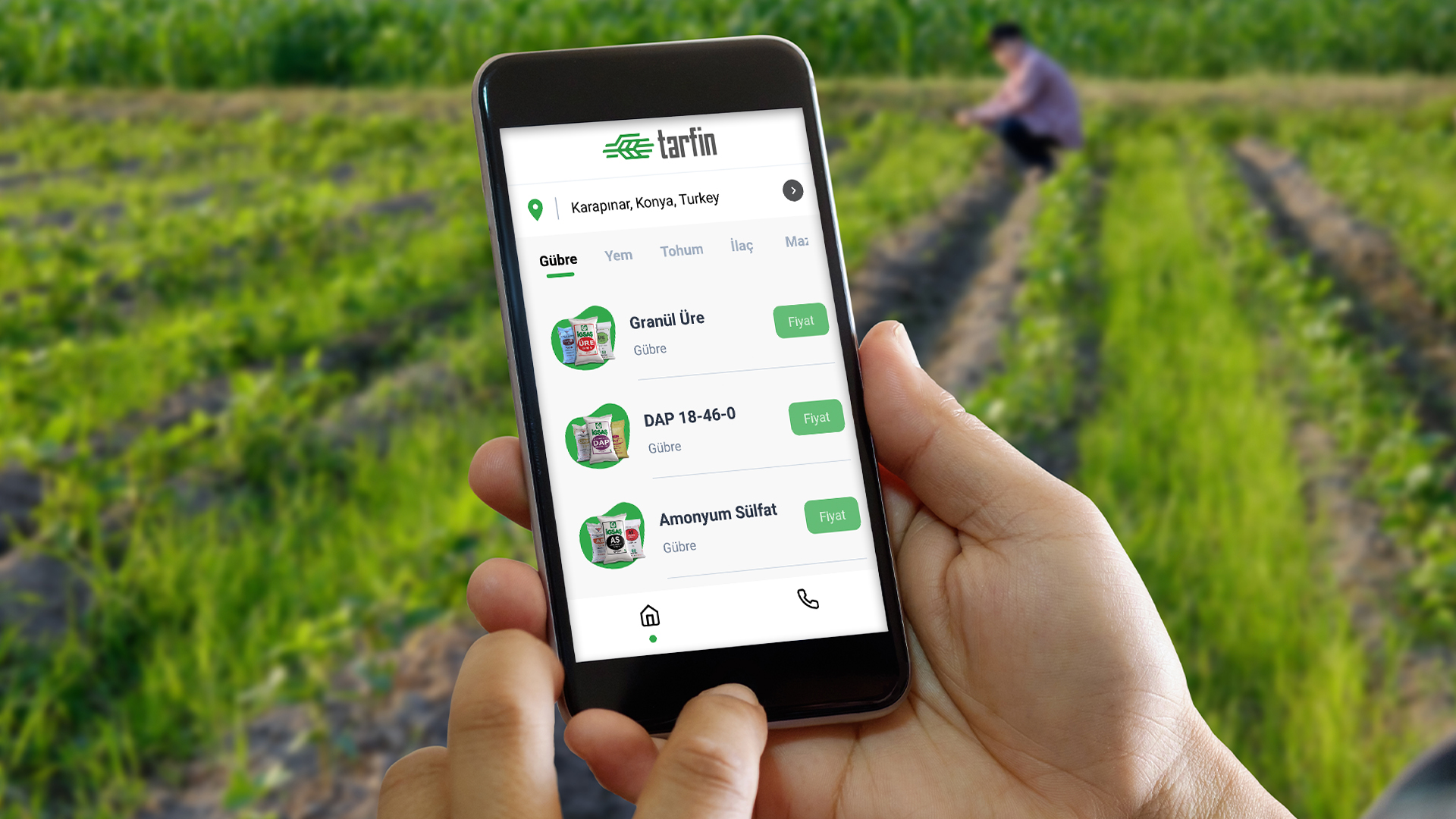

Tarfin: Buy now, pay at harvest

Founded in 2017, Tarfin is an agriculture fintech start-up based in Istanbul that has developed a mobile application to address the financial challenges farmers face. “It’s an innovative business model for the Turkish market, providing farmers with farm inputs and instant working capital financing,” says Mehmet Memecan, CEO.

Mehmet worked in the fertilizer business for several years before returning to Turkey. “When I came back, I saw how small-scale farmers faced difficulties in accessing financing to buy things like fertilizer or seeds. They don’t have cash until after harvest... Banks ask for collateral and the process of getting a loan is quite cumbersome. To make ends meet they resort to buying with vendor financing terms and the cost is high.” This is where Tarfin comes in. “We are a tech-based agricultural distributor,” explains Mehmet. “We sell the farm inputs farmers need with extended payment terms.” The Tarfin app helps farmers find the closest partner stores that offer the necessary inputs (e.g. fertilizer, seeds etc.), compare prices and instantly apply for financing. Then they can head to the store, sign a promissory note and walk away with the products.

“We built the underlying risk scoring models on advanced machine learning algorithms with four years of internal repayment performance data. In our scoring models, we utilize both conventional data as well as proprietary alternative data about the farmer and the transaction. We use our (over 300) retailer network across the country and our mobile app to help farmers conveniently access farm inputs with extended payment terms. No collateral, instant approval. And we’re about 8% cheaper than next door. Those savings can go to the farmer’s kids’ education, support overall household spending” Mehmet says.

Working with 15,000 farmers across Turkey, Tarfin has so far completed over 26,000 transactions. It boasts less than 2% default rates and is looking to expand to Eastern Europe in 2021. “Our solution is workable in other markets where there is fragmented agriculture and technology allows us to get to small ticket sizes that a bank wouldn’t bother looking at.” In 2018, Tarfin received an equity investment from Collective Spark, which helped the company grow. “We went from a small team of 4 to around 30 people. It helped build the tech infrastructure we have today and strengthened our balance sheet to make us also more attractive to banks and other creditors,” Mehmet explains.

Company: Tarfin (Istanbul, Turkey)

Type of business: agriculture, ICT

Financial intermediary: Collective Spark

EIF financing: Turkish Growth and Innovation Fund (TGIF)

For further information about EIF intermediaries in Turkey, please refer to:

http://www.eif.org/what_we_do/where/tr

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.