- What we do

- Pan-European Guarantee Fund – EGF

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- NPI SM-CDTI Innvierte Tech Transfer and Deep Tech

- ILTE: Co-investments into private credit funds

- RRF Spain - Alternative Lending for Sustainable Development

- EquiFund II

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czechia

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- SEGIP VC Fund - Call for expression of interest

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czechia Fund of Funds

Western Balkans Enterprise Development

Innovation Facility (WB EDIF)

- Date: 21 March 2019 - 31 December 2025

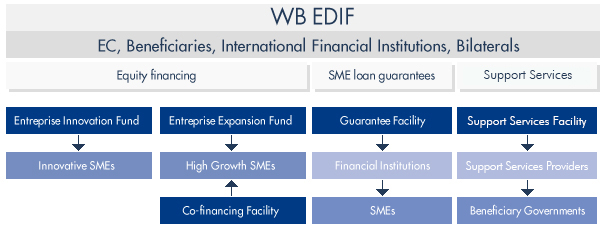

WB EDIF is an EU funded initiative which aims at increasing the financial resources made available to SMEs based in the Western Balkans, as well as support services for private sector development, to support socio-economic development and EU accession across the Region.

WB EDIF was launched in December 2012 by the European Commission, the EIF, the European Bank for Reconstruction and Development (EBRD) and the European Investment Bank (EIB), acting as co-lead international financial institutions.

The EUR 145 million of initial capital pulled together under WB EDIF may translate into about EUR 300 million of finance benefitting SMEs based in the Western Balkan countries.

What is WB EDIF’s geographical reach?

WB EDIF targets SMEs based in Albania, Bosnia and Herzegovina, Kosovo*, North Macedonia, Montenegro and Serbia.

How does WB EDIF work?

WB EDIF does not support entrepreneurs directly but provides funding to local financial intermediaries via debt and equity products as well as support services - e.g. venture capital funds, guarantee schemes including mutual guarantee organisations, micro-finance institutions and any other financial institution providing finance to SMEs established and operating in one or several of the Western Balkan countries mentioned above.

WB EDIF, which is coordinated by the European Investment Fund (EIF), consists of four pillars:

WB EDIF Guarantee Facility (WB EDIF GF)

Launched in 2013, the WB EDIF guarantee Facility instrument has undergone two rounds of financing ( GF I and GF II) and was greeted with high demand from the market, leading to the full allocation of the resources. The WB EDIF Guarantee Facility provides guarantees to eligible Financial Intermediaries established and operating in one or several Western Balkan countries to encourage them to build up new portfolios of SME transactions and thereby improving access to finance to SMEs in the Western Balkans countries.

Financial intermediaries were selected on the basis of a Call for Expression of Interest process, which closed on 30.06.2014.

Financial intermediaries under the GF II were selected on the basis of a Call for Expression of interest process which closed on 27.02.2017. Although the original closing date was set for 31 December 2017, the available budgetary resources have been exhausted and therefore the call has been closed accordingly.

WB EDIF Guarantee Facility – Serbia Window (WB EDIF GF Serbia)

Following the success of the initial implementation of the WB EDIF GF and WB EDIF GF II, a dedicated window is now open focusing on SMEs in Serbia. In line with the initial two facilities, GF Serbia will provide guarantees to eligible Financial Intermediaries established and operating in Serbia to encourage them to build up new portfolios of SME transactions and thereby improving access to finance to SMEs in Serbia.

Financial intermediaries under the WB EDIF GF Serbia were selected on the basis of a Call for Expression of interest process which closed on 15.04.2019. Although the original closing date was set for 31 December 2019, the available budgetary resources have been exhausted and therefore the call has been closed accordingly.

WB EDIF Guarantee Facility – Youth Employment (WB EDIF GF Youth)

Building on the successful results of WB EDIF GF and WB EDIF GF II and in parallel with a currently ongoing facility aimed at Serbian SMEs only, a dedicated Youth Employment window is now open to improve access to finance for SMEs in all Western Balkan Beneficiary Economies with a view to support youth employment in the region. WB EDIF GF Youth is a window of the Western Balkans EDIF Guarantee Facility, under which EIF will provide first-loss capped guarantees to selected Financial Intermediaries that build up a portfolio of debt instruments to SMEs established and operational in the Western Balkans region.

How to apply to the WB EDIF GF Youth Employment

Eligible Financial Intermediaries can apply to this instrument by downloading the application documents provided hereunder. The deadline by which to apply is 30 April 2020. EIF will select intermediaries after a due diligence process.

Call for Expression of Interest

Annex I – Expression of Interest

Annex II – Indicative Guarantee Term Sheet

Data inputs - Information Requirements

Terms of confidentiality

WB EDIF Guarantee Facility – Guarantee 4 SME Resilience

Building on the successful results of WB EDIF GF and WB EDIF GF II, and to support the resilience of SMEs in the Western Balkans following the COVID 19 crisis and the current energy crisis, the WB EDIF Guarantee4 SME Resilience (“WB EDIF GF4Resilience”) aims to respond to the economic distress with a view of supporting access to finance for SMEs in all Western Balkan Beneficiary Economies.

How to apply to the WB Guarantee 4 SME Resilience

The WB EDIF GF4Resilience portfolio guarantee can be structured either as a direct Guarantee or a Counter-Guarantee and in each case in the form of a first-loss capped (counter-) guarantee in accordance to the terms further described in Annexes II & III to this Call.

Eligible Financial Intermediaries can apply to this instrument by downloading the application documents provided hereunder. The deadline by which to apply is 31 December 2025. EIF will select intermediaries after a due diligence process.

Call for Expression of Interest

Annex I – Expression of Interest DOC | PDF

Annex II – Indicative Guarantee Term Sheet

Annex III – Indicative Counter-Guarantee Term Sheet

Appendix 1 – Glossary of terms

Terms of confidentiality

- Enterprise Innovation Fund (ENIF)

ENIF supports innovative SMEs in the Western Balkans in their early and expansion stage by providing equity finance through local funds management companies.

Eligible Fund Managers were selected on the basis of a Call of Expression of Interest process which closed on 14.06.2013. South Central Ventures was awarded with the role of ENIF Fund Manager as a result of this process.

- Enterprise Expansion Fund (ENEF)

Managed and advised by EBRD, ENEF supports the expansion of SMEs with a high-growth potential established in the Western Balkans. - Support Services Facility

Governments of the Western Balkan countries can obtain technical assistance under WB EDIF to implement policy reforms in order to create a favourable regulatory environment to benefit innovative and high-growth SMEs in the region.

For further information about WB EDIF, please visit www.wbedif.eu

*Kosovo: this designation is without prejudice to positions on status, and is in line with UNSCR 1244 and the ICJ Opinion on the Kosovo Declaration of Independence)

For SMEs :

- If you are looking for funding and would like to see which financial intermediaries currently cooperate with us, please visit http://www.eif.org/what_we_do/where/index.htm and contact the intermediary in your country directly

- For information about finance available under further EU initiatives, please visit http://europa.eu/youreurope/business/funding-grants/access-to-finance

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.