- What we do

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- The Social Impact Accelerator (SIA)

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- The Cyprus Entrepreneurship Fund (CYPEF)

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czech Republic

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- Slovene Equity Growth Investment Programme (SEGIP)

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

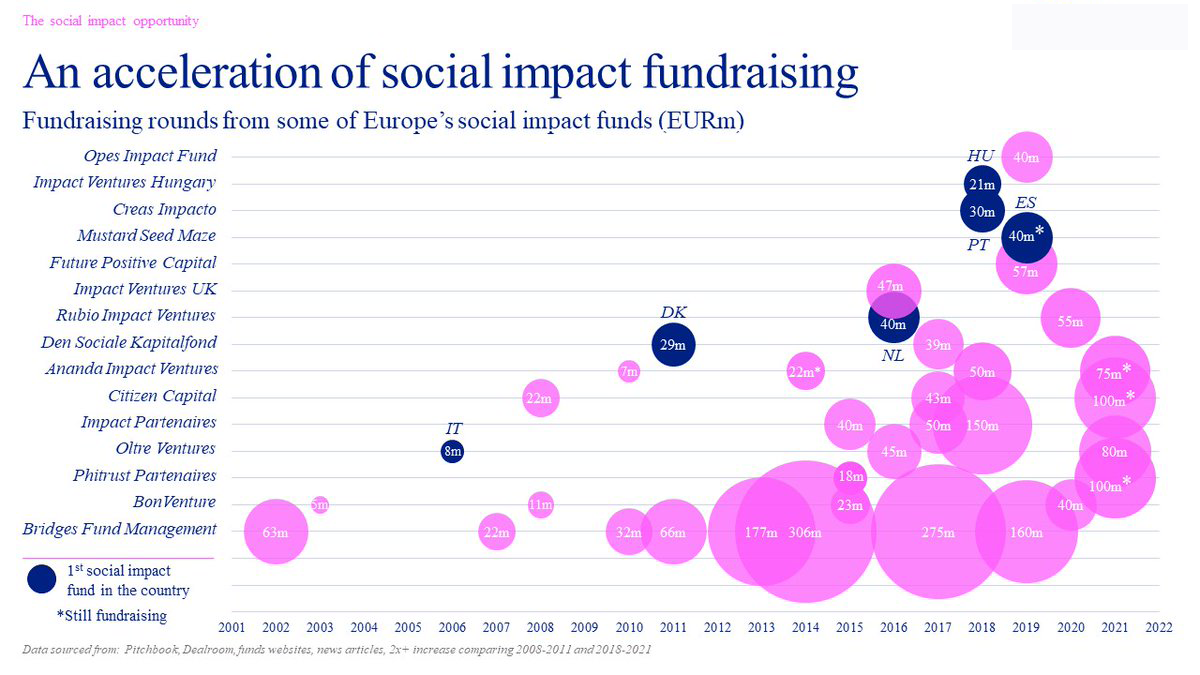

Impact investing at the EIF

We believe in investing for good. Whilst Europe’s social and environmental challenges are running deep and wide, the EIF has developed a unique expertise – and a toolkit of financial instruments – to address the financing needs of entrepreneurs making a difference. Hence, impact investing at the EIF is no longer concentrated in a single mandate or individual action. It is an investment approach that sits at the core of our equity funding strategy.

Why impact investing matters

Hundreds of businesses across Europe generate a positive social impact. For example, a start-up translating text into sign language, a publishing business focusing on creating interactive books for children with disabilities, a scale-up focusing on community building to re-share and overcome food waste, or a company that refurbishes old warehouses into basketball pitches for local communities. These entrepreneurs are making Europe a better place.

|

|

|

|

One of the problems in society is that the kids with functional diversity are not represented at the cultural level. But it’s not only representation, it’s also integration. ‘I kept wondering what we can do so that all children in the world could be protagonists in their own story. This is how MiCuento was born.’ Muriel Burgeois |

At least 10% of restaurant food ends up in the trash. On a global scale, this equals 11 million tons of food wasted every year. Food ‘rescuers’ have a role to play. ‘Our aspiration is zero-food-waste, globally. With our app we are also building a community: saving over 140 000 portions of food a month.’ Sauli Böhm |

Nearly 50 million people worldwide have Alzheimer’s disease. With ageing populations, both the number of affected patients and the associated financial costs are on the rise. ‘Cognitive training can help. It’s both about mental fitness and about supporting people to regain a life worth living.’ Jakob Futorjanski |

How we do it

Our motto: let’s make money care more. On the equity side, we make cornerstone investments in impact funds, as well as co-investments with accelerators and incubators. From pioneering and piloting some of the first impact investing schemes, we have come a long way. We committed to impact, and to breaking new ground in the EU venture capital and private equity ecosystem.

Flagship programmes to date:

|

EFSI Equity Instrument |

Social Impact Accelerator (SIA) |

|

|

We are convinced that social impact investing is becoming mainstream. Investments are targeting VC and PE funds backing social enterprises, social sector organisations or impact driven enterprises. We are focusing on funding solutions to societal and environmental issues, whilst generating benefits to society alongside economic value creation. Includes equity investments in skills & education. |

Through EFSI Equity, the European Commission and the EIF supported social entrepreneurship and social impact investors with dedicated funding. Part of the Investment Plan for Europe, the EFSI Equity Instrument was successful in strengthening the social impact investing approach, and our toolkit incl. innovative social outcome contract schemes and incubator funding. |

SIA was the first pan-European fund of funds initiative managed by the EIF providing equity funding support to social enterprises. SIA reached final closing in July 2015 at the size of €243 million, combining resources from the EIB / EIF, and other public and private investors, including Credit Cooperatif, Deutsche Bank, SITRA and the Bulgarian Development Bank. |

|

|

23 fund investments |

18 fund investments |

Meet the experts

Our impact

To support the sustainability and growth of such companies, the EIF’s impact investing initiatives are based on the idea that social goals can be compatible with financial success. We take cornerstone investments in impact funds and other providers of finance that back social entrepreneurs delivering impact and return – on average €300 million each year.

The EIF’s impact assessment methodology

To measure social impact, EIF has developed a unique framework for quantifying, reporting, and aligning interest on impact metrics at all levels of the investment chain. Social impact funds financed by EIF are asked to define between 1 and 5 social impact indicators per portfolio company and set quantifiable objectives for each of the indicators, at the moment of the investment.

Over time, EIF and its co-investors in a social impact fund will monitor portfolio companies’ progress towards achieving their social impact objectives. The fund manager will be held accountable for the social (or environmental) performance of its portfolio companies since the under or over achievement of such impact objectives will affect the distribution of carried interest to the management team.

Leveraging on the experience gained through the Social Impact Accelerator (SIA) instrument, the EIF is seeking to widen the scope of application of its impact framework beyond social impact to include other purpose-driven funds. The impact measurement methodology is thus being systematically implemented wherever possible in other areas of impact financing, such as climate and environment.

Read more

|

All social impact programmes managed by the EIF help to build a financing ecosystem because our guarantees and equity improve access to finance for SMEs and ‘crowd in’ private investors. Critical components of this ecosystem are microfinance lenders, social impact funds, and banks. Together, they improve access to finance for micro and social enterprises and attract private capital into the sector. Our Positive Social Impact digital brochure tells the full story. |

Let’s shake hands

Find here some of the upcoming impact investing events with the EIF’s participation:

|

CEE4Impact Day Registration required – more information: |

|

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.