- What we do

- Pan-European Guarantee Fund – EGF

- TechEU

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Innovation Romania Holding Fund

- NPI SM-CDTI Innvierte Tech Transfer and Deep Tech

- ILTE: Co-investments into private credit funds

- RRF Spain - Alternative Lending for Sustainable Development

- EquiFund II

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czechia

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- SEGIP VC Fund - Call for expression of interest

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

- EU4 Business Guarantee Facility and Grant Facility Call for Expression of Interest

- JEREMIE Romania Reflows

- Fomento Portugal Tech

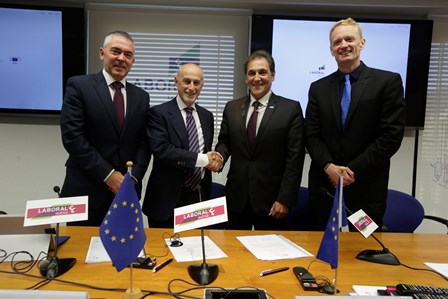

Investment Plan for Europe: EIF and LABORAL Kutxa sign EUR 100 million agreement to benefit innovative companies in Spain

- Date: 19 October 2016

The European Investment Fund (EIF) and Caja Laboral Popular Sociedad Cooperativa de Crédito (LABORAL Kutxa) have signed an InnovFin SME guarantee agreement to enhance access to finance to innovative small and medium-sized enterprises (SMEs) in Northern Spain. This transaction benefits from the support of the European Fund for Strategic Investments (EFSI), the heart of the Investment Plan for Europe. The EU’s support for innovative Spanish companies under this transaction is expected to generate a portfolio of EUR 100 million of bank loans.

The new agreement will allow LABORAL Kutxa to provide finance at more attractive conditions to SMEs over the next two years. EIF’s guarantee is provided under the “EU InnovFin finance for Innovators” initiative with the financial backing under Horizon 2020, the EU Framework Programme for Research and Innovation. The deal would not have been possible so soon without the backing of the Investment Plan.

European Commission Commissioner for Climate Action and Energy Miguel Arias Cañete said: “I am delighted to see Spanish companies benefitting from the Investment Plan for Europe through today’s Juncker Plan agreement with Laboral Kutxa. With EUR 100 million in finance to SMEs now available I would encourage SMEs in Northern Spain with investment needs to make the most of this new opportunity.”

Speaking at the signature event in Bilbao, EIF Chief Executive Pier Luigi Gilibert said: "Thanks to today’s EUR 100 million agreement with EIF, LABORAL Kutxa will be able to expand its range of financing solutions to SMEs and small mid-caps, with a particular focus on Northern Spain. This new EFSI InnovFin signature in Spain reflects EIF’s commitment to support the EU’s objective of creating a better investment environment across Europe.”

Txomin García, Chairman of LABORAL Kutxa, stressed the commitment of the Basque credit cooperative to promote business innovation, stating that "innovation, when applied to a company, results in greater competitiveness in the medium and long term, and, as a consequence, in the generation of sustainable wealth. InnovFin will also allow LABORAL Kutxa to be more competitive because it will help us to provide more and cheaper credit."

Josu Arraiza, Head of the Business area at LABORAL Kutxa, underlined the role of LABORAL Kutxa as a catalyst for business revitalisation, calling the agreement "a milestone that illustrates our vocation for aligning with ourselves alongside the companies in our environment so that together we may contribute to strengthening a solid and future-proof business community."

This transaction with LABORAL Kutxa reflects the EU's commitment to rapidly launch concrete initiatives under the EFSI, accelerating lending and guaranteeing transactions capable of boosting jobs and growth in the EU.

About EIF

The European Investment Fund (EIF) is part of the European Investment Bank group. Its central mission is to support Europe's micro, small and medium-sized businesses (SMEs) by helping them to access finance. EIF designs and develops venture and growth capital, guarantees and microfinance instruments which specifically target this market segment. In this role, EIF fosters EU objectives in support of innovation, research and development, entrepreneurship, growth, and employment. More information on EIF's work under the EFSI is available here.

About LABORAL Kutxa

LABORAL Kutxa is a credit cooperative with more than 50 years of history that is integrated in the Mondragon Group. It carries out its financial activity providing products and services to more than 1,200,000 families and businesses. Its network of 348 offices for individuals, self-employed and microenterprises are located in major population centres in the northern half of the country. It also has 12 exclusive offices for SMEs, to the extent that one out of every two Basque companies is a customer of LABORAL Kutxa.

The figures at the end of 2015 show a sound balance and profit and losses, with EUR 18,753 million of funds under management and EUR 13,638 million of loans. It shows high levels of solvency, with a CET1 capital ratio (fully loaded) of 16.06%, and a consolidated net profit after taxes amounting to EUR 110.3 million. More information is available at www.laboralkutxa.com.

About the Investment Plan for Europe

The Investment Plan focuses on strengthening European investments to create jobs and growth. It does so by making smarter use of new and existing financial resources, removing obstacles to investment, providing visibility and technical assistance to investment project. The Investment Plan is already showing results. The European Investment Bank (EIB) estimates that by October 2016, the European Fund for Strategic Investments (EFSI) triggered more than EUR 138 billion of investment in Europe.

Building on this success, the European Commission on 14 September 2016 proposed extending the EFSI by increasing its firepower and duration as well as reinforcing its strengths. Find the latest EFSI figures including a break-down by sector and by country here. For more information see the FAQs.

About InnovFin

The InnovFin SME Guarantee Facility provides guarantees and counter-guarantees on debt financing of between EUR 25,000 and EUR 7.5 million in order to improve access to loan finance for innovative small and medium-sized enterprises and small mid-caps (up to 499 employees). The facility is managed by EIF, and is rolled out through financial intermediaries – banks and other financial institutions – in EU Member States and Associated Countries. Under this facility, financial intermediaries are guaranteed by EIF against a proportion of their losses incurred on the debt financing covered under the facility.

Press contacts:

EIF: David Yormesor

Tel.: + 352 24 85 81 346, E-Mail: d.yormesor@eif.org

LABORAL Kutxa: Jokin Gorriti

Tel.: + 34 64 66 24 621, E-Mail: jokin.gorriti@laboralkutxa.com

European Commission: Siobhán Millbright

Tel.: + 32 (0)2 29 57 361, E-Mail: siobhan.millbright@ec.europa.eu

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.