- What we do

- Pan-European Guarantee Fund – EGF

- TechEU

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Innovation Romania Holding Fund

- NPI SM-CDTI Innvierte Tech Transfer and Deep Tech

- ILTE: Co-investments into private credit funds

- RRF Spain - Alternative Lending for Sustainable Development

- EquiFund II

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czechia

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- SEGIP VC Fund - Call for expression of interest

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

- EU4 Business Guarantee Facility and Grant Facility Call for Expression of Interest

- JEREMIE Romania Reflows

- Fomento Portugal Tech

How EFSI benefits SMEs in Europe - ING case study: Flen Pharma (Luxembourg), Medical device company

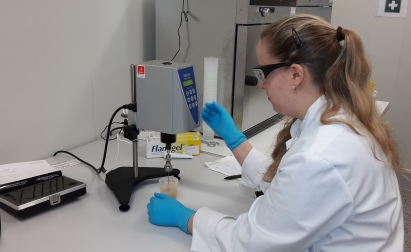

It was during a barbecue, at which the daughter of one of his friends was badly burned, that the idea came to Philippe Sollie, pharmacist by profession, to develop a new type of wound care product. The little girl was allergic to a large number of ingredients contained in the traditional creams, so Philippe developed a simple to use, but extremely effective gel, labelled ‘Flamigel®’, which keeps the wound moist. This has the advantage of continuously cleaning the wound, speeding up the healing process and avoiding any scar tissue.

After having filed a patent, Philippe encountered huge success with his innovative idea. Building on his passion for pharmaceutical research and his motivation to contribute to a better quality of life, he developed a whole range of medical devices based on the same principles. With ‘Flaminal® Hydro’ and ‘Flaminal® Forte’, which he has been distributing first in Europe and later across the world, from his base in Esch-sur-Alzette, Luxembourg, he created a new product class: the ‘Enzyme Alginogel®’. It combines two principles of fast and efficient wound healing by achieving a bacterial balance (using enzymes) and a moisture balance (using alginates) in the wound. Moreover, ‘Flaminal®’, unlike other wound care gels, can be used on all tissues and throughout all phases of wound healing, making the life of wound experts and their patients easier.

To further expand his activity, Philippe secured an EU-guaranteed loan provided by ING Luxembourg and backed by EIF under the Investment Plan for Europe. This EU initiative aims to generate new investments by facilitating access to finance for small and medium-sized enterprises. Philippe has used part of his loan to open a franchise in the United Kingdom (Flen Health) allowing for the creation of its own network of distributors. Furthermore, Philippe is planning to use the other part of the loan to hire two additional researchers and invest in the research and development of his products.

Today, Philippe employs around 75 staff and continues to offer through ‘Flen Pharma’ and ‘Flen Health’ a new class of wound healing products, reducing pain and trauma after injury.

Company: Flen Pharma (Luxembourg)Type of business: Medical device company

EIF financing: InnovFin SMEG, EFSI

For further information abiout EIF intermediaries in Luxembourg, please refer to: http://www.eif.org/what_we_do/where/lu

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.