- What we do

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- The Social Impact Accelerator (SIA)

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- The Cyprus Entrepreneurship Fund (CYPEF)

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czech Republic

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- Slovene Equity Growth Investment Programme (SEGIP)

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

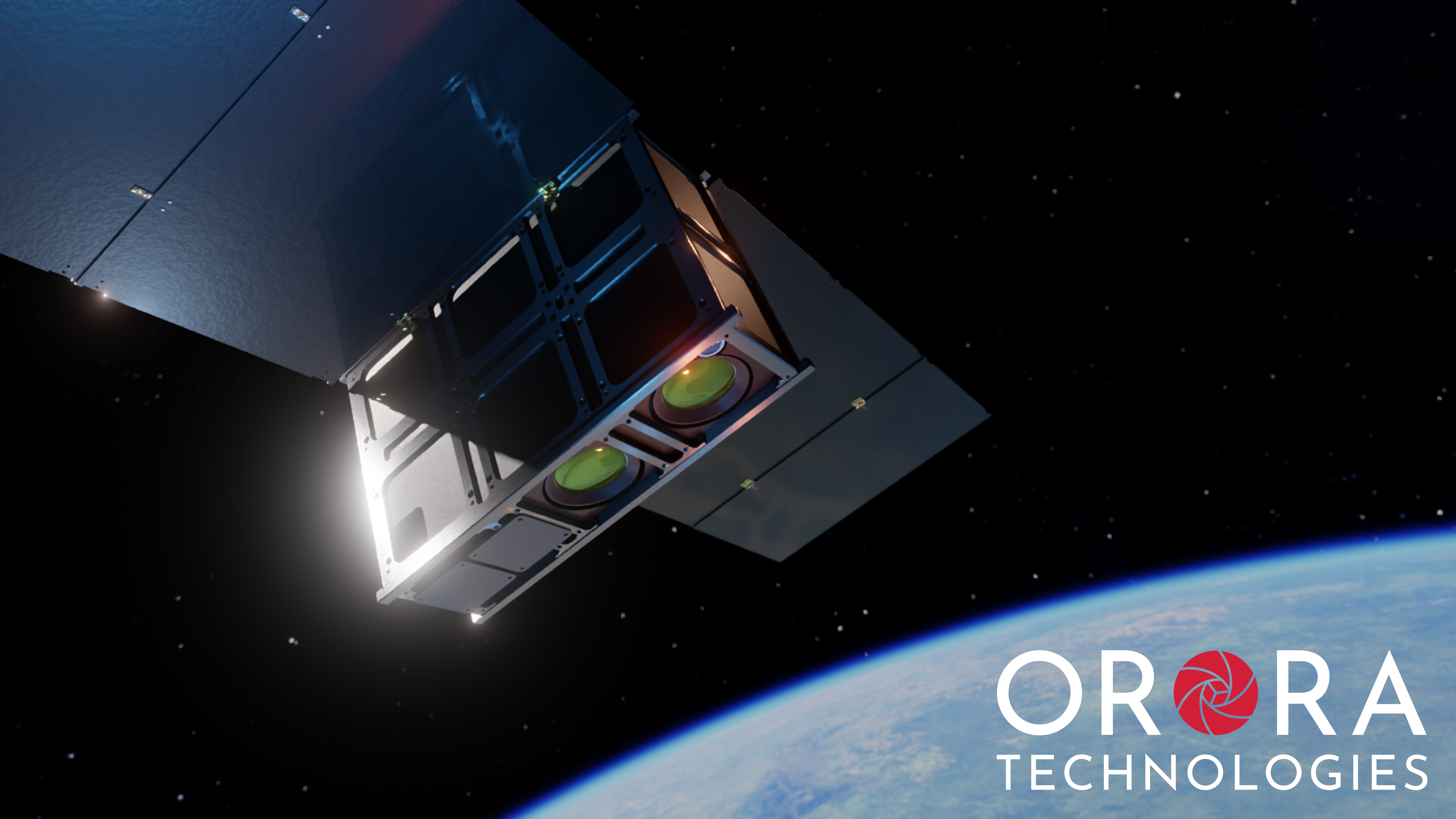

OroraTech: saving the planet from space

Climate change generates extreme weather events with devastating consequences like wildfires. “Droughts and rising temperatures are causing wildfires that are burning areas the size of India every year. Our Earth has a fever,” says Thomas Gruebler, co-founder and CEO of OroraTech. “18% of global CO2 emissions come from wildfires. The best way to fight climate change is through precise temperature data because it’s all connected to temperature. If we use this data efficiently, we can do a lot to protect the planet,” he adds.

Founded in 2018 as a spin-off from a research project at the Technical University of Munich, the data intelligence start-up has developed technology which analyses temperature data from a myriad of Earth-orbiting satellites watching for, and reporting wildfires, mainly by monitoring temperature. Early detection can minimise their impact on the environment.

“With this technology we can see through smoke from space, accurately monitor any heat event on the ground and then process the data using artificial intelligence,” he says. On top of that, historical data also helps with fire risk assessment and forecasting. Users of the platform are notified as soon as a problem is identified so that they’re faster to put the fires out and can build a map of where the threat is most likely to come.

Up until recently, the company was analysing data from existing satellites, but in January 2022 launched its own state of the art satellite. “It’s the size of a shoebox, the result of years of research. In a few years, we will take the earth’s temperature every 30 minutes with a fleet of these satellites.” With eyes covering the entire planet, the company can now collect data, analyse it with the AI component and transmit the information within three minutes, feeding it to users like forest preservation agencies, firefighters, and others on the front line back on the ground. “Typically, these people are using planes or lookout towers to detect and monitor fires on the ground. We offer a similar service at a fraction of the cost.”

Launching an innovative start-up and scaling it requires financing at multiple stages. OroraTech found in EIF-backed venture capital firm Ananda Impact Ventures an investor keen to support it through every step of its development, from R&D in the beginning to product launch and expansion more recently. “We’ll be launching ten satellites in the course of the next two years,” Thomas says. “Our platform is now being used by clients in South America, Australia and South Africa and we are constantly expanding.” With a little creativity, it’s easy to see how this can also be applied to smart cities, monitoring temperatures, and helping with city planning. But for the moment, OroraTech is out in space focussing on saving the planet from wildfires.

Company: OroraTech (Germany)

Type of business: AI, space, climate action & environmental sustainability

EIF financing: SIA

For further information about EIF intermediaries in Germany, please refer to: http://www.eif.org/what_we_do/where/de

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.