- What we do

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- The Social Impact Accelerator (SIA)

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- The Cyprus Entrepreneurship Fund (CYPEF)

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czech Republic

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- Slovene Equity Growth Investment Programme (SEGIP)

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

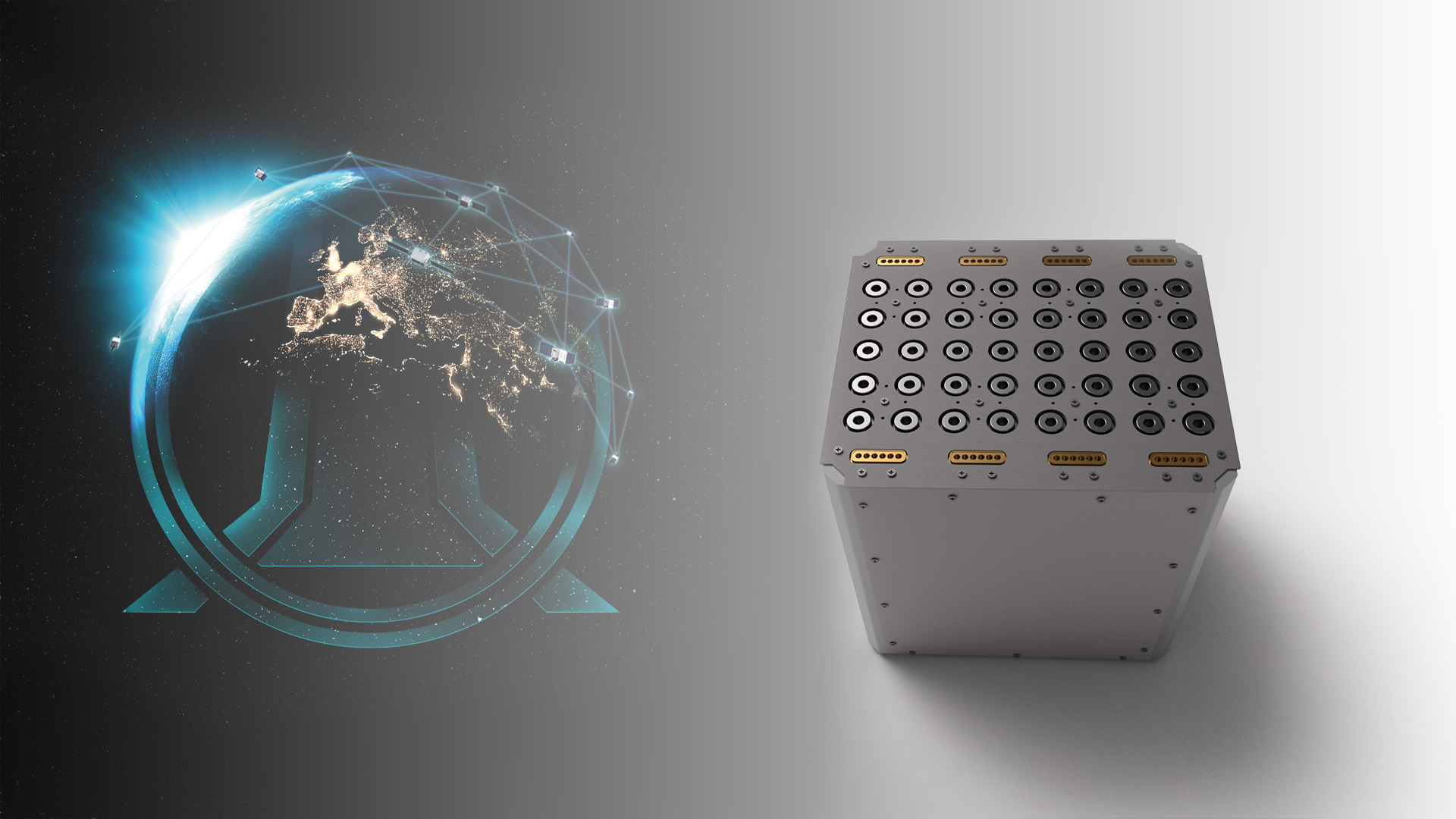

Morpheus Space: making space for everyone

“Space is critical infrastructure for our society, with many different applications. From earth observation to communication, space helps us connect the world and understand it better. To figure out climate change, agriculture, transport…” explains Daniel Bock, CEO and co-founder of Morpheus, a company that is redefining space mobility.

ACTION IN SPACE, FLEXIBILITY ON EARTH

Daniel and his team are developing an all-in-one satellite mobility platform that includes the hardware with their scalable propulsion solutions and all the software behind it. “Essentially we help satellites move in space,” he says. “We’re moving away from large, single, expensive satellites to constellations and networks of hundreds of smaller, affordable satellites. There’s a lot more going on. But these constellations are planned many years in advanced, built and finally deployed into space without actually being very responsive to changing circumstances. That doesn’t really address the needs of the rapidly changing world we live in. But with our technologies, we are now bringing flexibility to business models and means to react on events down on Earth. We are doing this by providing automated mobility solutions for satellites that can simply rearrange the shape of these constellations in a dynamic way — even when the satellites are already in space. Our technology helps prevent satellite collisions in space and reduce space debris which is one of the biggest challenges of the space industry.”

UNIVERSITY SPIN-OFF

Daniel was doing a PhD in space engineering, at TU Dresden, looking at electric propulsion, but that project was interrupted: “I never finished the PhD because Morpheus came in between,” he explains. Meeting his co-founder at university, the company spun-off from a university project in 2018. Today, the company has costumers all over Europe and North America, and in 2020, received an equity investment from VSquared, a venture capital firm backed by the EIF and the EU, which allowed the team to finalise the hardware product development, initiate the software development and expand to the US.

SCALING & DEMOCRATISING

Now that the company has established itself, the next step is scale: “We’ll soon be extending our production capacity, to mass produce our hardware, grow the business and capture the market. At the same time, we’re working on bringing it all together in one holistic platform, decreasing technical barriers, and making it more user-friendly, democratising access to space.”

Company: Morpheus Space (Dresden, Germany)

Sector: space

Number of employees: >50

Financial Intermediary: Vsquared Ventures

Financing purpose: product development

EIF financing: InnovFin Equity, ERP, EGF, LfA

For further information about EIF intermediaries in Greece, please refer to: http://www.eif.org/what_we_do/where/el

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.