Dutch Future Fund (DFF)

- Date: 03 November 2020

The Dutch Future Fund (DFF) is a new initiative launched by the EIF in close collaboration with the Dutch national promotional institution Invest-NL to offer fresh funding to innovative Dutch SMEs.

Both parties agreed to commit EUR 150 million, making EUR 300 million available to invest in venture and growth capital funds that have a strong commitment to innovative SMEs in the Netherlands. It is expected that EIF, as the manager of the programme, will be able to construct a balanced portfolio of 15 to 20 funds.

DFF aims to support the Dutch economy and contribute to preparing it for the future by focussing on areas such as digital innovation, artificial intelligence, life sciences and key enabling technologies; as well as thematic objectives such as energy transition, sustainability and the circular economy, all of which are priorities for The Netherlands and the EIB Group. The initiative is also aimed at supporting companies, which have been impacted by the ongoing Covid-19 pandemic.

After the successful implementation of the two Dutch Venture Initiative programmes (DVI and DVI-II), DFF will be the third equity fund-of-funds (FoF) programme advised by EIF targeting innovative SMEs in the Netherlands.

Based on historical experiences with similar initiatives in the Netherlands, DFF expects that, through the crowding-in of additional private investors, it will mobilise a total of around EUR 1.5 billion in equity investments into SMEs.

Are you a fund manager interested in partnering with us under DFF?

We are looking for qualified and credible partners, with extensive experience in Venture Capital. You will be eligible to receive DFF’s financial resources to enable further investments into high-tech early and development stage companies, if you meet the following criteria, amongst others:

- Your investment strategy has a strong focus on the Netherlands.

Please outline and explain how the proposal would fit in the current competitive VC landscape, which sector and stage the fund is targeting and how the know-how of the team matches the Fund’s investment strategy; - Your team is well-balanced, with team members complementing each other in terms of skills and experience, with a proven ability to work together. Emerging and/or first time teams may also be considered;

Furthermore:

- Your track record should prove adequate experience in the targeted investment area; previous investment successes and failures will be carefully analysed in order to understand the investment capabilities of the team;

- The fund should be capable to attract further private finance from other investors, e.g. family offices, HNWI’s, pension funds, insurance companies or funds-of-funds, which should at least double the amount of investment capital requested from DFF;

- The fund size should be commercially viable to ensure the team’s stability and the fund’s investment capacity;

- The legal and tax structure of the fund should be clear and transparent according to best market practices, and should include market-standard terms and conditions;

- Stakeholders in a fund have aligned interests.

Should your investment proposal meet the criteria listed above, your team will need to pass several additional screenings, before a full due diligence process is started and taken further into EIF’s internal decision-making process.

Financial intermediaries - Apply here

If you are a financial intermediary or a fund manager and you are interested in receiving an investment from EIF under DFF, please read more about how to submit your investment proposal to the EIF or be in touch with your existing EIF relationship manager.

Information for final beneficiaries (SMEs and small mid-caps):

Information on DFF investee funds will be published on the EIF website once the selection and the approval procedures are completed.

In the meantime, you are looking for finance, check EIF's financial intermediaries already active or located in your country.

The DFF implementation progress

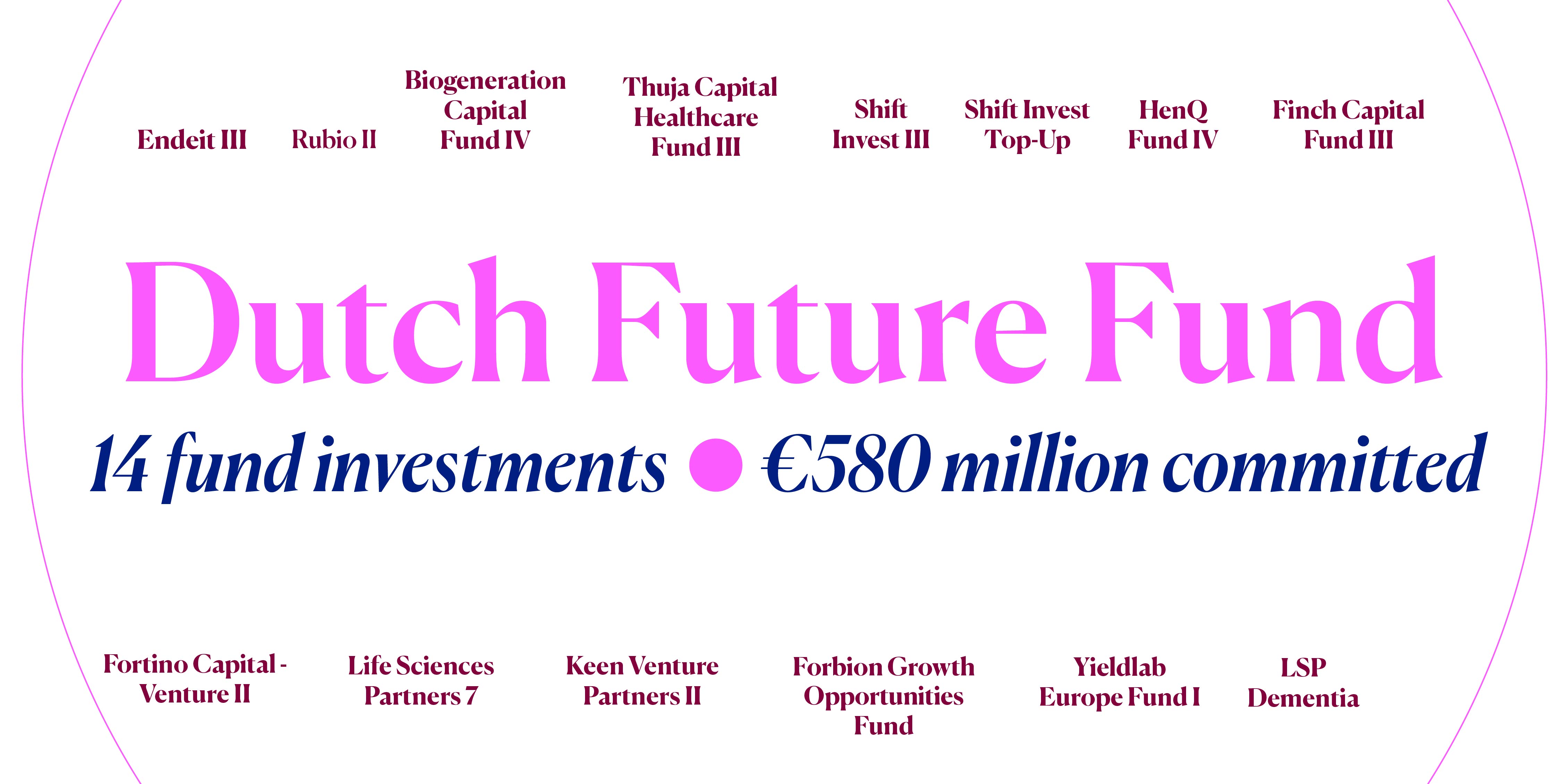

So far we’ve made 14 investments in investee funds, committing EUR 580 million. An additional investment is awaiting approval.

DFF investments at 30.06.2023

- Blume Equity Fund I

- Future Food Fund II

- Rubio Impact Fund II

- Biogeneration Capital Fund IV

- Thuja Capital Healthcare Fund III

- Shift Invest III

- HenQ Fund IV

- Finch Capital Europe Fund III

- Yieldlab Europe Fund I

- Forbion Growth Opportunities Fund

- Endeit Fund III

- Fortino Capital - Venture II

- Life Sciences Partners 7

- Keen Venture Partners Fund II

- Prime Ventures VI

- LSP Dementia Fund

- Forward.One Fund II

- PureTerra Ventures I

- World Fund I

- Junction Growth Investors Fund

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.