Careers at the EIF

Your future starts here. Discover more about our vacancies, values, and hiring processes on our careers page.

With more than 700 staff members from across Europe (and counting), the EIF offers a truly diverse and multicultural environment for experienced professionals, students and young graduates who want to make a difference. Believing in entrepreneurship and the impact of small businesses for the European economy means we are working for a purpose.

The EIF’s headquarters are in the heart of Europe – we are in Luxembourg alongside other European institutions and the European Investment Bank with several regional and local offices closer to our network of financial intermediaries, partners and entrepreneurs. Together, we can make a unique contribution to a more competitive, innovative, and inclusive Europe.

Types of opportunities

Are you a student or a young graduate? Our internships and early career programmes might be unique opportunities to learn more about what we mean by working for a purpose. By working with different teams in the organisation, you’ll gain valuable, hands-on experience in the European SME and infrastructure financing landscape and beyond.

Are you an experienced professional? Keep an eye on our job portal as well as our LinkedIn page to stay tuned to our vacancies and selection processes for officers in our different areas of operation. Check out our hiring roadmap for more information here.

Our structure

The EIF employs professionals across 5 offices - functional areas contributing to its mission to support SMEs. These are:

-

Finance and Strategy Office: financial control and strategy

-

General Secretariat: legal services, governance, audit and institutional affairs, institutional relations

-

Investment Office: debt transactions (guarantees, securitisation and inclusive finance), equity investments, client services, mandate origination and relationship management, mandate design and product development, and central front office services

-

Risk Office: compliance and nonfinancial risk, capital management and financial risk, transaction and mandate risk, portfolio risk management and surveillance

-

People Office: talent management, performance, talent acquisition, learning and development, as well as HR operations and administration

Entry-level and professional development opportunities, offered through early career and traineeship programs, are spread across all the job streams, allowing young professionals to get experience across all the different areas.

Check out our organisational structure as at 30 November 2025.

Staff rules, salaries and benefits

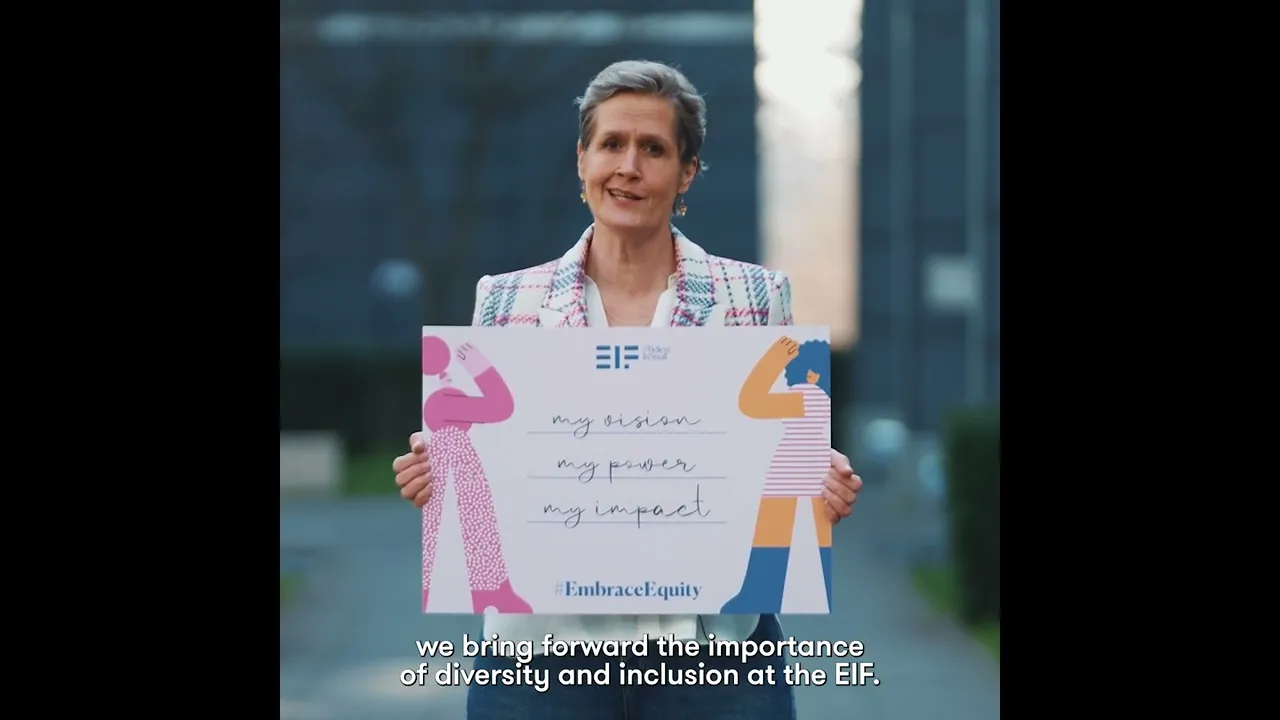

Diversity and inclusion

Among the first European organisations, the EIF has obtained the EDGE Assess certification in March 2022. During this process we reinforced our commitment to regularly evaluate our internal policies related to diversity and inclusion.

The EDGE Certification recognises the collective commitment at the EIF to realise gender equality from top to bottom, and to foster an environment where differences are valued. Our staff share an equal sense of community, reward, and development.

What we care about

Watch the EIF's Ann Hansen, Head of Talent Acquisition and Development, as she shares more about our commitment to diversity and inclusion.