- What we do

- Institutional investors

- Equity products

- AI Co-Investment Facility

- Cleantech Co-Investment Facility

- Impact investing at the EIF

- Climate & Infrastructure Funds

- Technology Transfer

- European Angels Fund (EAF) - Co-investments with Business Angels

- Venture capital

- The Social Impact Accelerator (SIA)

- Lower mid-market

- Mezzanine Facility for Growth

- VentureEU

- EFSI Equity instrument

- Single EU Equity Financial Instrument

- Private equity secondary market transactions

- EIF-NPI Equity Platform

- ESCALAR Programme

- Debt products

- New ESIF ERDF Guarantee Fund initiative in Greece

- EFSI Private Credit Programme

- AGRI Guarantee Facility

- AGRI Italy Platform Uncapped Guarantee Instrument

- Credit enhancement

- Cultural and Creative Sectors Guarantee Facility (CCS GF)

- ENSI - Securitisation Initiative

- Erasmus+ Master Loan Guarantee Facility

- Skills & Education Guarantee Pilot

- EREM debt products

- Single EU Debt Financial Instrument

- Documentary Finance Facility – Bulgaria

- The SME Initiative

- Inclusive finance

- European Fund for Strategic Investments (EFSI)

- Regional Development - Country and sector-specific initiatives

- Normandie Garantie Agri

- FAIRE - La Réunion

- Auvergne Rhône-Alpes FEADER

- Recovery Equity Fund of Funds of Bulgaria

- Fons d’Inversió en Tecnologia Avançada (FITA) Catalonia

- Dutch Future Fund (DFF)

- Dutch Alternative Credit Instrument (DACI)

- PORTUGAL BLUE: a new initiative for blue economy investments

- JEREMIE Greece Reflows – Business Angels’ Co-Investment Equity Instrument

- German Corona Matching Facility (CMF)

- Portugal Growth programme

- Central and Eastern European Technology Transfer (CEETT)

- Croatian Growth Investment Programme (CROGIP) II

- Croatian Growth Investment Programme (CROGIP)

- Croatian Venture Capital Initiative 2 (CVCi 2)

- AGRI Italy Platform Uncapped Guarantee Instrument

- DISPOSITIF INSTRUMENTS FINANCIERS BOURGOGNE FRANCHE-COMTÉ

- ALTER’NA – ESIF EARFD Nouvelle-Aquitaine

- Baltic Innovation Fund 1 (BIF 1)

- Baltic Innovation Fund 2 (BIF 2)

- Central Europe Fund of Funds (CEFoF)

- Croatian Venture Capital Initiative (CVCi FoF)

- Competitiveness Fund-of-Funds for SMEs in Romania

- The Cyprus Entrepreneurship Fund (CYPEF)

- Deep and Comprehensive Free Trade Area Initiative East Guarantee Facility (DCFTA)

- EU4Business Capped Guarantee

- Dutch Growth Co-Investment Programme

- Dutch Venture Initiative (DVI-II)

- ESIF Fund-of-Funds Greece

- EAFRD FoF Portugal

- EAFRD FoF Romania

- The ERP-EIF Facility

- ERP-EIF Co-Investment Growth Facility

- The LfA-EIF Facilities

- The German Future Fund (GFF) - EIF Growth Facility

- INAF – French National Agricultural Initiative

- ESIF Energy Efficiency and Renewable Energy Malta

- Regional Fund-of-Funds Romania

- ESIF Fund-of-Funds Czech Republic

- The Silesia EIF Fund of Funds

- La Financière Région Réunion

- The EIB Group Risk Enhancement Mandate (EREM)

- EstFund

- Call for Expression of Interest for FOSTER II

- Greater Anatolia Guarantee Facility (GAGF)

- G43 - Anatolian Venture Capital Fund Project

- InvestBG Equity Instrument

- JEREMIE

- Romania Recovery Equity Fund of Funds

- JEREMIE Romania Reflows – Equity Instrument

- Luxembourg Future Fund 1 (LFF)

- Luxembourg Future Fund 2

- Mezzanine 'Fund of Fund' for Germany (MDD)

- NEOTEC resources

- Polish Growth Fund of Funds (PGFF)

- Portugal Venture Capital Initiative (PVCi)

- Scottish-European Growth Co-Investment Programme

- Slovene Equity Growth Investment Programme (SEGIP)

- Swedish Venture Initiative (SVI)

- Turkish Growth and Innovation Fund (TGIF)

- Western Balkans Enterprise Development & Innovation Facility (WB EDIF)

- EAFRD FoF Greece

- Irish Innovation Seed Fund (IISF)

- RRF Czech Republic Fund of Funds

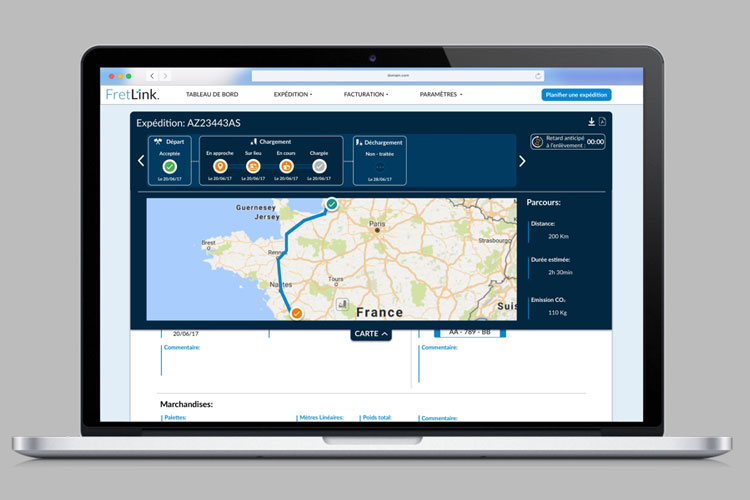

How EFSI benefits SMEs in Europe - Daphni Purple case study: Fretlink (France), Software for logistics/transportation management

The connection between shippers and carriers is the dynamic process at the heart of the global logistics industry. It is, however, a traditionally fragmented market with a multitude of actors and different interfaces leading to inefficiencies and great cost in terms of time and money. “It is estimated that one truck in four runs empty and the average fill-rate of trucks is just 70%. Paradoxically, Europe is also facing a shortage of trucks and drivers at the same time” explains Paul Guillemin, CEO of Fretlink, who are out to improve efficiency in this space.

Fretlink is a French company born when a web entrepreneur, a logistics management expert and an economist specialized in optimization came together to look into the business opportunity presented by this inefficiency.

Together, they have developed a software platform that serves as a tool linking shippers to carriers, applying new technologies to the world of logistics and transportation. This software-as-a-service (SaaS) marketplace aims to bring significant added value through optimization of the transport of goods. By connecting the marketplace with fast, flexible and mobile software, Fretlink enables any professional shipper to find an adequate carrier, estimate rates and track his shipment. For the carrier, there is no need to examine thousands of offers or spend time negotiating, as the software takes care of finding the lots that match his needs.

This is pretty much how Kronenbourg beer crates found themselves travelling alongside designer-brand fashion items from Showroomprivé.com. “They were both shipping from the same area with extra space in the trucks. We connected the dots, and the result works for both companies and the environment as well” Paul explains.

Fretlink received an investment from Daphni Purple, a venture capital fund backed by EIF under the EU’s Investment Plan for Europe which aims to generate new investments into European SMEs. This allowed the company to recruit new talent to boost their operational and web development teams. “The investment was key in our efforts to scale up and secure big-name clients like Carlsberg and P&G. Large corporate clients want certainty and security” Paul explains. “They can’t take any risks with their merchandise and we need to be able to deliver in a competitive market.” Looking ahead, Fretlink are expanding their business eastwards, having recently opened an office in Sofia.

Company: Fretlink (France)

Type of business: Software for logistics/transportation management

EIF financing: InnovFin SMEG, EFSI

Financial intermediary: Daphni Purple

For further information about EIF intermediaries in France, please refer to: http://www.eif.org/what_we_do/where/fr

We use cookies to give the best browser experience on our website. or change cookie settings.

Copyright ©

European Investment Fund – The European Investment Fund is not responsible for the content of external internet sites.